Question: The expected-value technique represents a methodology to choose among investment opportunities. Below are two investment opportunities where information is available to use the expected-value technique

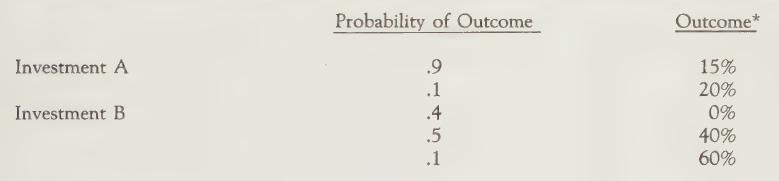

The expected-value technique represents a methodology to choose among investment opportunities. Below are two investment opportunities where information is available to use the expected-value technique in choosing among investments. You may assume that both alternatives require the same outlay of resources and have the same investment life.

Required:

a. Which investment should be chosen if you use the expected value approach? Support your answer with appropriate calculations.

b. The expected value approach forces managers to consider some things that would not otherwise be considered using a ‘best estimate” approach. What are these additional factors introduced for consideration by the expected value approach?

c. Considering the two investments above, what basic assumptions underlie the expected value approach that might deter a division manager from using only the results from the expected value technique in making the investment decision?

Investment A Investment B Probability of Outcome Outcome* 91456 .9 15% .1 20% 0% .5 40% 60%

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts