Assuming a forward contract to sell 100,000 Israeli shekels was entered into on December 1, Year 1,

Question:

Assuming a forward contract to sell 100,000 Israeli shekels was entered into on December 1, Year 1, as a fair value hedge of a foreign currency receivable, what would be the net impact on net income in Year 1 resulting from a fluctuation in the value of the shekel?

a. No impact on net income.

b. A $58.80 decrease in net income.

c. A $2,000 decrease in income.

d. A $911.80 increase in income.

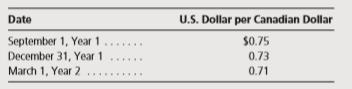

On September 1, Year 1, Keefer Company received an order to sell a machine to a customer in Canada at a price of 100,000 Canadian dollars. The machine was shipped and payment was received on March 1, Year 2. On September 1, Year 1, Keefer Company purchased a put option giving it the right to sell 100,000 Canadian dollars on March 1, Year 2, at a price of $75,000. Keefer Company properly designates the option as a fair value hedge of the Canadian-dollar firm commitment. The option cost $1,700 and had a fair value of $2,800 on December 31, Year 1. The fair value of the firm commitment is measured through reference to changes in the spot rate. The following spot exchange rates apply:

Step by Step Answer: