In this question assume all dollar units are real dollars in billions, so, for example, $150 means

Question:

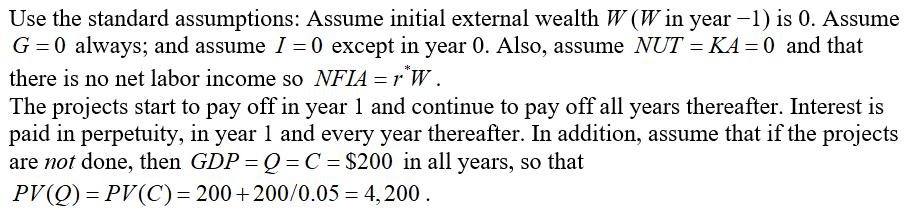

In this question assume all dollar units are real dollars in billions, so, for example, $150 means $150 billion. It is year 0. Argentina thinks it can find $150 of domestic investment projects with a marginal product of capital (MPK) equal to 10% (each $1 invested in year 0 pays off $0.10 in every later year). Argentina now invests $105 in year 0 by borrowing $105 from the rest of the world at a world real interest rate r* of 5%. There is no further borrowing or investment after this.

a. Should Argentina fund the $105 worth of projects? Explain your answer.

b. Why might Argentina be able to borrow only $105 and not $150?

c. From this point forward, assume the projects totaling $105 are funded and completed in year 0. If the MPK is 10%, what is the total payoff from the projects in future years?

d. Assume this payoff is added to the $200 of GDP in all years starting in year 1. In dollars, what is Argentina’s in year 0, year 1, and later years?

e. At year 0, what is the new PV(Q) in dollars? Hint: To ease computation, calculate the value of the increment in PV(Q) due to the extra output in later years.

f. At year 0, what is the new PV(I) in dollars? Therefore, what does the LRBC say is the new PV(C) in dollars?

g. Assume that Argentina is consumption smoothing. What is the percent change in PV(C)? What is the new level of C in all years? Is Argentina better off?

h. For the year the projects go ahead, year 0, explain Argentina’s balance of payments as follows: state the levels of CA, TB, NFIA, and FA.

i. What happens in later years? State the levels of CA, TB, NFIA, and FA in year 1 and every later year.

Step by Step Answer: