Nearly all governments impose tariffs (taxes) on some imports into their countries. Most governments do not impose

Question:

Nearly all governments impose tariffs (taxes) on some imports into their countries. Most governments do not impose additional taxes (duties) on their exports. Still, WTO rules allow countries to impose export taxes. In the mid-2000s about half of WTO member countries did have some duties on their exports. Typically, this is a developing country (e.g., Argentina, Russia) imposing duties on its exports of one or more agricultural or other primary products. Why would some countries impose extra taxes on their exports? What effects do export taxes have? Let’s start with the effects because understanding the effects provides clues to the reasons.

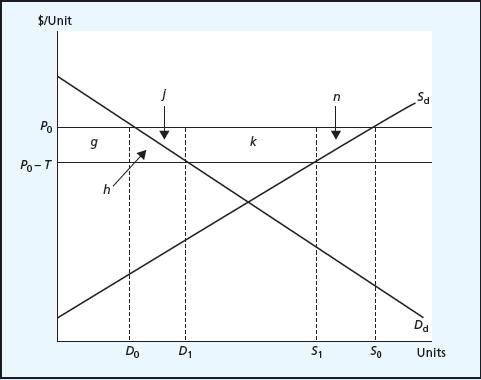

Consider a small exporting country, one whose supply of exports has essentially no effect on world prices of its exports. The figure shows the country and the world price P0. If there is no export tax, the country produces the quantity S0, consumes the quantity D0, and exports the difference, S0 2 D0. Now the country’s government imposes an export tax equal to T dollars per unit exported

(a rate that reduces but is not high enough to completely eliminate exports of this product).

What changes (and what does not change)?

For a small country, the world price P0 does not change. So, after the government collects the tax, domestic producers receive revenue net of tax on their exports of only (P0 2 T). These producers will try to shift some sales to local consumers, who initially are willing to pay more.

But as competitive domestic producers strive to make more domestic sales, the domestic price is also driven down to (P0 2 T ). At the new price of (P0 2 T ) received for both domestic sales and exports, the country’s quantity produced falls to S1, quantity consumed increases to D1, and quantity exported decreases to (S1 2 D1).

Well-being changes, for groups within the country and for the country overall. Consumers gain surplus of area g 1 h, producers lose surplus of area g 1 h 1 j 1 k 1 n, the government gains export tax revenue equal to area k, and the country suffers deadweight losses equal to areas j and n. Area j is the inefficiency of domestic overconsumption of the product—the units from D0 to D1 are worth less to domestic consumers than the P0 price that the country would receive from foreign buyers if instead these units were exported. Area n is the inefficiency of national underproduction of the product—the units from S1 to S0 cost the country less to produce than the price P0 that foreign buyers would be willing to pay for them if they were produced and exported.

As you can see, the effects of an export tax for a small country are analogous to the effects of an import tariff for a small country.

What about a large exporting country that imposes an export tax? This case is also analogous, and you may want to try to draw the graph yourself. The large exporting country has national monopoly power in the world market. It can use an export tax to limit its export supply and drive up the world price of the product. The country benefits from the higher world price for its export product, and there is a nationally optimal export tax that could maximize its net gains from enhancing its terms of trade in this way (assuming that the rest of the world is passive).

Why do we see some countries using export taxes (and other restrictions on exports)? The analysis provides insights. First, the country’s government may use export taxes, as it would use any other tax, to raise revenue for the government. Second, the country’s government may use export taxes to benefit local consumers of the product. The local consumers could be households. For example, in reaction to the increases in world food prices during 2007–2008, a number of countries (including Thailand, Vietnam, and India) increased export taxes or otherwise restricted exports of agricultural products like rice and sugar to keep local food prices low. Or the local consumers could be firms in other industries that use this product as an input into their production. The export tax artificially lowers their production costs and encourages the expansion of these user industries. Third, for a large country, the country’s government may be using the export tax to gain national well-being at the expense of foreign buyers.

Are export taxes a good idea? For the first two reasons (more revenue or lower domestic prices), the government is achieving some other objective at the cost of the deadweight losses. For the third reason (exploiting national monopoly power), the country is risking retaliation by foreign countries, and the export tax is reducing global efficiency.

DISCUSSION QUESTION In March 2012 the Indian government prohibited the export of cotton. What are the possible reasons for this export ban? Which one or two seem to be the most plausible reasons?

Step by Step Answer: