As defined in footnote 3, cross exchange rates are exchange rates quoted against currencies other than the

Question:

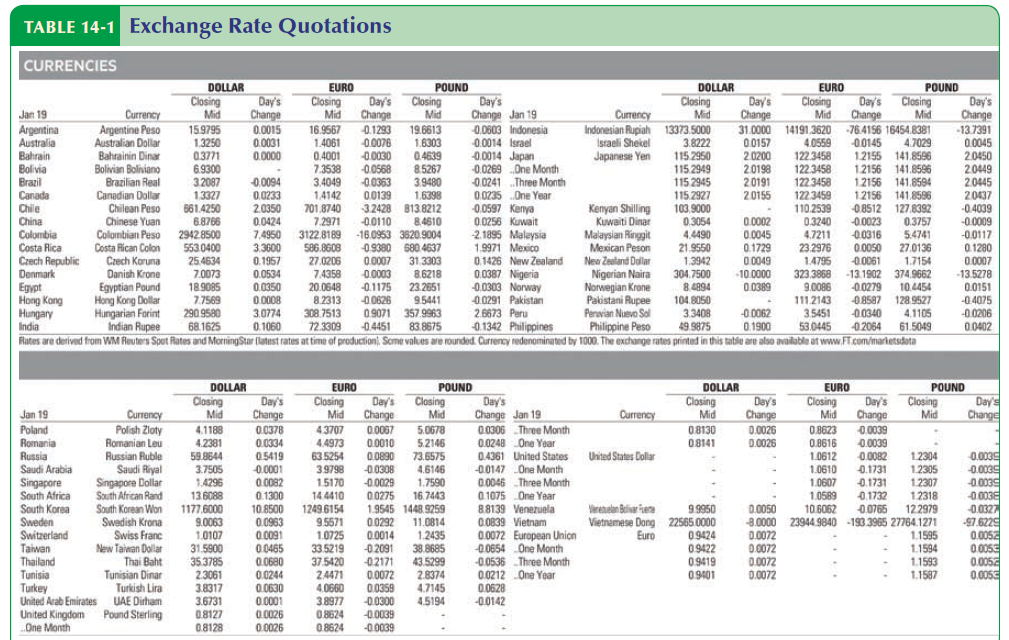

As defined in footnote 3, cross exchange rates are exchange rates quoted against currencies other than the U.S. dollar. If you return to Table 14-1, you will notice that it lists not only exchange rates against the dollar, but also cross rates against the euro and the pound sterling. The fact that we can derive the Swiss franc/Israeli shekel exchange rate, say, from the dollar/franc rate and the dollar/shekel rate follows from ruling out a potentially profitable arbitrage strategy known as triangular arbitrage. As an example, suppose the Swiss franc price of a shekel were below the Swiss franc price of a dollar times the dollar price of a shekel. Explain why, rather than buying shekels with dollars, it would be cheaper to buy Swiss francs with dollars and use the francs to buy the shekels. Thus, the hypothesized situation offers a risk less profit opportunity and therefore is not consistent with profit maximization.

TABLE 14-1 Exchange Rate Quotations CURRENCIES EURO Closing Mid 16.9567 DOLLAR Closing Mid 13373.5000 3.8222 115.2950 115.2949 115 2945 115.2927 103.9000 0.3054 4.4490 POUND Closing Day's Mid Change DOLLAR Closing Mid POUND Closing Day's EURO Closing Day's Change Day's Change 0.0015 0.0031 Day's Change Day's Change Jan 19 Argentina Australia Bahrain Bolivia Brazil Canada Chile China Colombia Costa Rica Czech Republic Donmark Egypt Hong Kong Hungary India Rates are derived from WM Reuters Spet Rates and MorningStar (latest rates at time of production). Some values are rounded. Currency redenominated by 1000. The exchange rates printed in this tatle are also available at www.FT.com/marketsdata Change Jan 19 Currency Argentine Peso Australian Dollar Bahrainin Dinar Bolivian Boliniano Brazilian Real Canadian Dollar Chilean Peso Chinese Yuan Colombian Peso Costa Rican Colon Czech Koruna Danish Krone Currency Indonesian Rupiah Israeli Shekel Japanese Yen Mid Mid 19.6613 1.6303 159795 -0.1293 0.0076 0.0603 Indonesia 0 0014 Israel 0.0014 Japan 0.0269 One Month 0.0241 Three Month 0.0235 One Year 0.0597 Kenya 0.0256 Kuwait 31.0000 14191.3620 -76.4156 16454.8381 4.0559 122.3458 1223458 122.3458 122.3459 110.2539 -13.7391 1.3250 03771 69300 3.2087 1.3327 661.4250 6.8766 2942.8500 5530400 1.4061 0.4001 7.3538 3.4049 1.4142 701.8740 7.2971 00157 2 0200 20198 20191 20155 00145 12155 141.8596 12156 141.8596 1.2156 4.7029 0.0045 2.0450 0.0000 0.4639 85267 3.9480 1.6398 32428 813.8212 84610 -16.0953 3620.9004 0.9380 680 4637 31.3303 8.6218 23.2651 95441 09071 357.9963 83.8675 -0.0030 0.0568 0.0363 0.0139 20449 20445 20437 -0.4039 -0.0009 141.8594 141.8596 0.0094 0.0233 2.0350 0.0424 7.4950 3.3600 12156 0.8512 127.8392 -0.0023 Kenyan Shilling Kuwaiti Dinar Malaysian Ringgit Mexican Peson New Zeuland Dular Nigerian Naira Norwegian Krone Pakistani Rupee Pervian Nuvo Sal Philippine Peso 0.0110 0.0002 0.3240 4.7211 0.3757 2.1895 Malaysia 1.9971 Mexico 0.1426 New Zealand 0.0387 Nigeria 0.0303 Norway 0 0291 Pakistan 2 6673 Peru 0.1342 Philippines 3122.8189 586.8608 27.0206 7.4358 20.0648 8.2313 308.7513 72.3309 0.0045 0.1729 0 0049 -10.0000 0.0389 0.0316 5.4741 -0.0117 0.1280 0.0007 -13.5278 0.0151 -0.4075 23.2976 1.4795 27.0136 21.9550 1.3942 304.7500 8.4894 104.8050 3.3408 49.9875 0.0050 0.0061 323.3868 -13.1902 374.9662 0.0279 08587 128.9527 0 0340 53.0445 -02064 61.5049 0.1957 0.0534 0.0350 25.4634 7.0073 189085 7.7569 290 9580 68.1625 0.0007 0.0003 0.1175 0.0626 1.7154 Egyptian Pound Hong Kong Dollar Hungarian Forint Indian Rupee 9.0086 111.2143 3.5451 10.4454 0.0008 3.0774 4.1105 -0.0206 00402 -0 0062 -0.4451 0.1060 0.1900 POUND Closing EURO EURO DOLLAR DOLLAR POUND Closing Mid Day's Change Closing Day's Day's Change Jan 19 0.0306 Three Month Closing Mid Closing Mid Closing Mid Day's Change Dey's Change 0.0026 0.0026 Day's Change Jan 19 Poland Romania Russia Currency Currency Polish Zloty Romanian Leu Russian Ruble Saudi Riyal Singapore Dollar South African Rand South Korean Won Swedish Krona Swiss Franc New Taiwan Dolar Thai Baht Tunisian Dinar Turkish Lira UAE Dirham Pound Sterling Mid Change Mid 4.1188 4.2381 59.8644 3.7505 1.4296 13.6088 0.0378 0.0334 0.5419 0.0001 0.0082 0.1300 10.8500 0.0963 0.0091 00465 0.0680 0.0244 0.0630 0.0001 0.0026 0.0026 4.3707 4.4973 63.5254 3.9798 15170 14 4410 0.0067 0.0010 0.0890 -0.0308 5.0678 5.2146 73.6575 4.6146 1.7590 16.7443 08130 0.8623 0.8616 0.0039 0.0039 0.0248 One Yoar 0.4361 United States -0.0147 One Month 0.0046 Three Month 0 1075 One Year 88139 Venezuela 0.0839 Vietnam 0.0072 European Union 0.0654 One Month 0.0536 Three Month 0.0212 One Yoar 0.0628 -0.0142 08141 United States Dollar 0.0082 0.1731 0.1731 0.1732 0.0035 0.003S 0.0039 1.0612 1.0610 1.0607 1.0589 1.2304 1.2305 1.2307 1.2318 Saudi Arabia Singapore South Africa South Korea Sweden Switzerland Taiwan Thailand 0.0025 00275 1.9545 1448.9259 0.0292 0.003E 0.0327 -97.6229 0.0052 0.0053 0.0052 0.0053 0.0050 0S666 9 950 22565 0000 1177.6000 9.0063 1.0107 31.5900 1249.6154 9.5571 1.0725 33.5219 Verenelan Belivar Fuene Vietnamese Dong Euro 10.6062 8.0000 23944 9840 -193.3965 27764.1271 0.0765 122979 11.0814 1.2435 09424 09422 09419 09401 0.0014 0.0072 0.0072 0.0072 0.0072 1.1595 1.1594 1.1593 1.1587 0 2091 38.8685 35.3785 2.3061 3.8317 3.6731 0.8127 0.8128 37.5420 2,4471 4.0660 3.8977 0.8624 08624 02171 43.5299 2.8374 Tunisia Turkey United Arab Emirates United Kingdom One Month 0.0072 0.0359 4.7145 4.5194 0.0300 0.0039 -0039

Step by Step Answer:

If it were cheaper to buy Israeli shekels with Swi...View the full answer

International Economics Theory and Policy

ISBN: 978-0134519579

11th Edition

Authors: Paul R. Krugman, Maurice Obstfeld, Marc Melitz

Students also viewed these Business questions

-

If you return to Figure 9-4, you will notice that London Eurodollar interest rates tend to exceed U.S. certificate of deposit rates after the global financial crisis, but not before. Why do you think...

-

Suppose that the spot Swiss francs per dollar exchange rate is $:SFr = 1.5960-70 and the three-month forward exchange rate is $:SFr= 1.5932-62. a. Is the Swiss franc trading at a discount or at a...

-

If the Swiss franc depreciates against the U.S. dollars can a dollar buy more or fewer Swiss francs as a result?

-

The unadjusted trial balance of Simple Consulting Services as at December 31, 2021 is as follows: Cash Accounts receivable Prepaid insurance Supplies inventory Office equipment Accumulated...

-

On January 1, 2013, Lani Company entered into a non-cancelable lease for a machine to be used in its manufacturing operations. The lease transfers ownership of the machine to Lani by the end of the...

-

At the beginning of 2025 Spartan Corp enters into a contract to build a luxury yacht for a customer that is expected to take three years to complete. The contract price is $4,000,000. Completion is...

-

FRAUD PREVENTION AND DETERRENCE IN ACTION Assume the following facts: thirty-day collection period. The invoice is used to post-sales to the accounting system. Checks are received in the mailroom and...

-

Morris Corporation is publicly owned, and its shares are traded on a national stock exchange. Morris has 16,000 shares of $2 stated value common stock authorized. Only 75% of these shares have been...

-

XYZ Inc., a well-known manufacturer of inflatable boats is considering a new project, a thickened inflatable boat. Thickened boat is of higher quality and double the price of the normal inflatable...

-

Jerry Stevenson is the manager of a medical clinic in Scottsdale, AZ. He wants to analyze patient data to identify high-risk patients for cardiovascular diseases. From medical literature, he learned...

-

If you go to the BEA website for U.S. International Transactions (http://wwwbea.gov/iTable/iTable.cfm?reqid=62&step=1&isuri=1#reqid=62&step=6&isuri=1&6210=1&6200=1), table 1.1, you will find that in...

-

Table 14-1 reports exchange rates not only against the U.S. dollar, but also against the euro and the pound sterling. (Each row gives the price of the dollar, euro, and pound, respectively, in terms...

-

Evolutionary change caused by natural selection results in species with a. greater complexity. b. less complexity. c. greater reproductive success in their environment. d. the ability to survive...

-

What is the kinetic energy of a 126.7 cm thin uniform rod with a mass of 442.2 g that is rotating about its center at 4.82 rad/s? Give your answer in Joules.

-

What are the unexplained and explained portions of the wage gap, using group B's slope as a baseline? WA Weekly Wage 1,300 1200 1100 1000 900 800 WB 700 600 500 Group A: slope = 50 Group B: stope =...

-

Purchase Price $33,500.00 Finance Rate Table less Term No Rebate Rebate Down Payment $3,500.00 1 12.50% 19.70% Trade-in Value $4,500.00 2 14.90% 20.90% Rebate $1,000.00 3 17.30% 22.10% 4 18.50%...

-

A hoop is rolling without slipping along a horizontal surface with a forward speed of 4.81 m/s when it starts up a ramp that makes an angle of 18.79 with the horizontal. What is the linear speed of...

-

Could you analyze the utilization of symbolism and metaphorical imagery within the narrative framework to convey deeper layers of meaning?

-

In what way did the implementation of the Uruguay Round help developing nations? In what way did it not?

-

On average there are four traffic accidents in a city during one hour of rush-hour traffic. Use the Poisson distribution to calculate the probability that in one such hour there arc (a) No accidents...

-

The Internet has allowed for increased trade in services such as programming and technical support, a development that has lowered the prices of such services relative to those of manufactured goods....

-

Countries A and B have two factors of production, capital and labor, with which they produce two goods, X and Y. Technology is the same in the two countries. X is capital-intensive; A is...

-

Economic growth is just as likely to worsen a countrys terms of trade as it is to improve them. Why, then, do most economists regard immiserizing growth, where growth actually hurts the growing...

-

Wells Technical Institute (WTI) provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid...

-

The function P(x)=0.35x-73 models the relationship between th e number of pretzels x that a certain vendor sells and the profit the vendor makes. Find P(1,000), the profit the vendor makes from...

-

Thermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management...

Study smarter with the SolutionInn App