The Fisher effect (Chapter 6) suggests that nominal interest rates differ between countries because of differences in

Question:

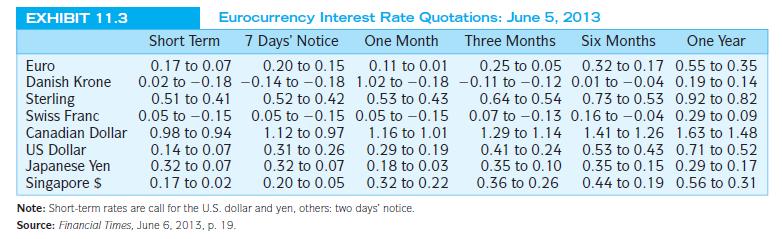

The Fisher effect (Chapter 6) suggests that nominal interest rates differ between countries because of differences in the respective rates of inflation. According to the Fisher effect and your examination of the one-year Eurocurrency interest rates presented in Exhibit 11.3, order the currencies from the eight countries from highest to lowest in terms of the size of the inflation premium embedded in the nominal ask interest rates for June 5, 2013.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

International Financial Management

ISBN: 9780077861605

7th Edition

Authors: Cheol Eun, Bruce Resnick

Question Posted: