FF Ltd acquired 80% of the ordinary share capital of GG Ltd on 1 April 2016. On

Question:

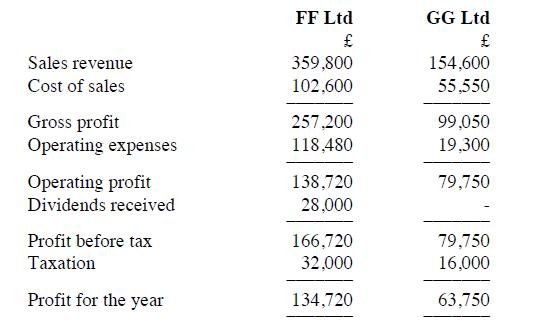

FF Ltd acquired 80% of the ordinary share capital of GG Ltd on 1 April 2016. On that date, the retained earnings of GG Ltd were £18,260. There are no preference shares. The statements of comprehensive income of FF Ltd and GG Ltd for the year to 31 March 2020 are as follows:

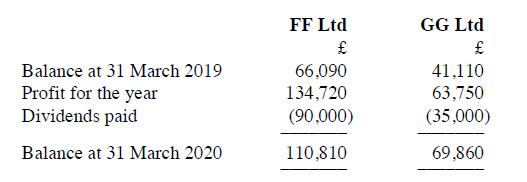

The statement of changes in equity for FF Ltd and GG Ltd show the following retained earnings figures for the year to 31 March 2020:

On 4 March 2020, FF Ltd sold goods to GG Ltd for £10,000. These goods had cost FF Ltd £6,000. One-quarter of them were included in GG Ltd's inventory at 31 March 2020.

Required:

(a) Prepare a consolidated statement of comprehensive income for the year to 31 March 2020, assuming that there are no impairment losses in relation to goodwill.

(b) Prepare an extract from the consolidated statement of changes in equity for the year to 31 March 2020, showing the changes in the group's retained earnings.

Step by Step Answer: