Petford plc prepares accounts to 31 December each year. On 1 January 2019, the company acquired a

Question:

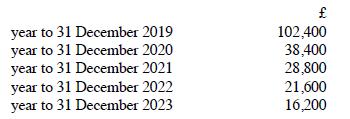

Petford plc prepares accounts to 31 December each year. On 1 January 2019, the company acquired a non-current asset at a cost of £256,000 and decided to depreciate this asset on the straight-line basis over a five-year period, assuming a residual value of £nil. The depreciation allowed for tax purposes with regard to this asset in the first five years of ownership was as follows

The company's pre-tax profit (after charging depreciation) was £500,000 for the year to 31 December 2019 and this remained at a consistent £500,000 per annum for each of the next four years.

The company's pre-tax profit (after charging depreciation) was £500,000 for the year to 31 December 2019 and this remained at a consistent £500,000 per annum for each of the next four years.

Step by Step Answer:

International Financial Reporting a practical guide

ISBN: 9781292439426

8th Edition

Authors: Alan Melville