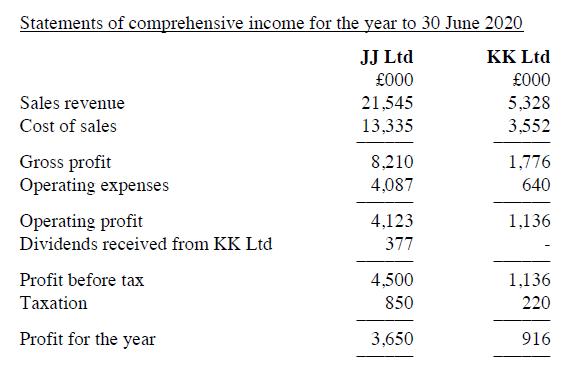

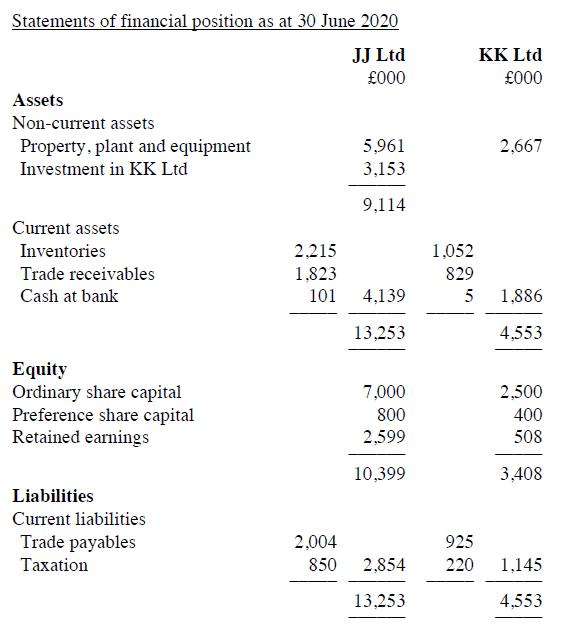

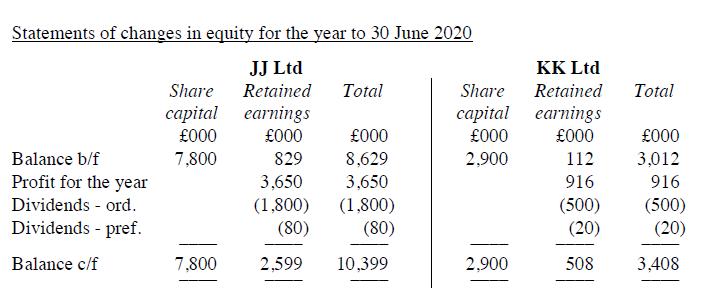

The financial statements of JJ Ltd and KK Ltd for the year to 30 June 2020 are

Question:

The financial statements of JJ Ltd and KK Ltd for the year to 30 June 2020 are shown below:

The following information is also available:

1. On 1 July 2016, JJ Ltd paid £3,153,000 to acquire 75% of the ordinary shares and10% of the preference shares of KK Ltd. On that date, the retained earnings of KK Ltd were £704,000.

2. The fair value of the non-current assets of KK Ltd on 1 July 2016 exceeded their carrying amount by £600,000. This valuation has not been reflected in the books of KK Ltd.

3. KK Ltd has issued no shares since being acquired by JJ Ltd.

4. Goodwill had suffered impairment losses of 30% by 30 June 2019 and there was a further impairment loss during the year to 30 June 2020. This further impairment loss is equal to 10% of the amount originally paid for goodwill.

5. JJ Ltd sells goods to KK Ltd at cost plus 60%. During the year to 30 June 2020, these sales totalled £2,400,000, of which £216,000 was still owing to JJ Ltd at the end of the year. The inventory of KK Ltd at 30 June 2020 includes goods bought from JJ Ltd for £512,000.

6. Any depreciation consequences of the fair value adjustment may be ignored.

Required:

(a) Prepare a consolidated statement of comprehensive income for the year to 30 June 2020.

(b) Prepare a consolidated statement of changes in equity for the year to 30 June 2020.

(c) Prepare a consolidated statement of financial position as at 30 June 2020.

(d) Explain how each of these financial statements would differ if the intra-group sales described above were from KK Ltd to JJ Ltd (rather than from JJ Ltd to KK Ltd).

(e) Explain how the consolidated financial statements would differ if the depreciation consequences of the fair value adjustment were not ignored. It may be assumed that the financial statements of KK Ltd for each of the four years to 30 June 2020 would have been charged with additional depreciation of £40,000 if the company had revalued its non-current assets to their fair value on 1 July 2016.

Step by Step Answer: