Question: Using the example of the lifetime value for the current donor base with the current system, calculate the LTV with the new system. A charity

Using the example of the lifetime value for the current donor base with the current system, calculate the LTV with the new system. A charity is considering implementing a new e-mail marketing system to increase donations from its donors. The charity’s main role is as a relief agency which aims to reduce poverty through providing aid, particularly to the regions that need it most. Currently, its only e-mail activity is a monthly e-newsletter received by its 200,000 subscribers which features its current campaigns and appeals. It hopes to increase donations by using a more targeted approach to increase donations based on previous customer behaviour. The e-mail system will integrate with the donor database which contains information on customer profiles and previous donations.

The company is considering three solutions which will cost between £50,000 and £100,000 in the first year. In the charity, all such investments are assessed using lifetime value modelling.

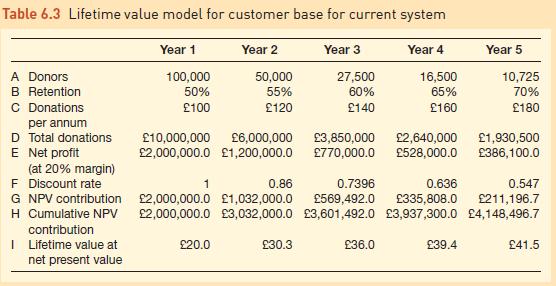

Table 6.3 is a lifetime value model showing customer value derived from using the current system and marketing activities.

A Donors – this is the number of initial donors. It declines each year dependent on the retention rate (row B).

B Retention rate – in lifetime value modelling it is usually found to increase year-on-year, since customers who stay loyal are more likely to remain loyal.

C Donations per annum – likewise, the charity finds that the average contributions per year increase through time within this group of customers.

D Total donations – calculated through multiplying rows B and C.

E Net profit (at 20% margin) – LTV modelling is based on profit contributed by this group of customers, row D is multiplied by 0.2.

Table 6.3 Lifetime value model for customer base for current system Year 1 Year 2 Year 3 Year 4 Year 5 A Donors B Retention 100,000 50,000 27,500 16,500 10,725 50% 55% 60% 65% 70% 100 D Total donations 10,000,000 2,000,000.0 1,200,000.0 1 20.0 C Donations per annum E Net profit (at 20% margin) F Discount rate G NPV contribution H Cumulative NPV contribution I Lifetime value at net present value 2,000,000.0 1,032,000.0 569,492.0 2,000,000.0 3,032,000.0 3,601,492.0 3,937,300.0 120 140 160 180 6,000,000 3,850,000 2,640,000 1,930,500 770,000.0 528,000.0 386,100.0 0.86 0.7396 0.636 0.547 335,808.0 211,196.7 4,148,496.7 30.3 36.0 39.4 41.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts