Question: Figure 14.24 is a term sheet for a step-up note paying a fixed rate that changes during the life of the contract. Plot the price/yield

Figure 14.24 is a term sheet for a step-up note paying a fixed rate that changes during the life of the contract. Plot the price/yield curve for this product today, ignoring the call feature. What effect will the call feature have on the price of this contract?

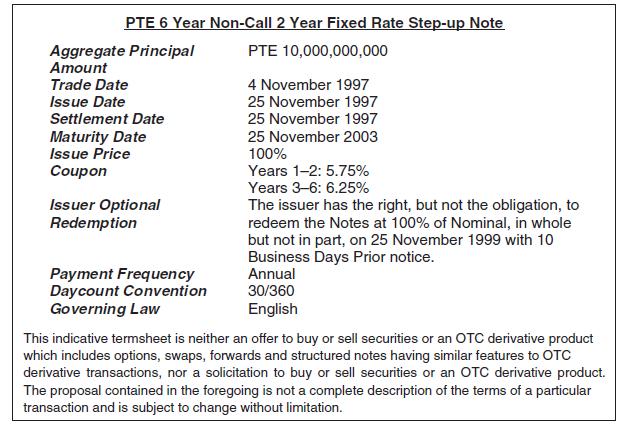

Figure 14.24

PTE 6 Year Non-Call 2 Year Fixed Rate Step-up Note Aggregate Principal Amount PTE 10,000,000,000 Trade Date 4 November 1997 Issue Date 25 November 1997 Settlement Date 25 November 1997 Maturity Date Issue Price 25 November 2003 100% Coupon Years 1-2: 5.75% Years 3-6: 6.25% Issuer Optional Redemption The issuer has the right, but not the obligation, to redeem the Notes at 100% of Nominal, in whole but not in part, on 25 November 1999 with 10 Business Days Prior notice. Annual Payment Frequency Daycount Convention Governing Law 30/360 English This indicative termsheet is neither an offer to buy or sell securities or an OTC derivative product which includes options, swaps, forwards and structured notes having similar features to OTC derivative transactions, nor a solicitation to buy or sell securities or an OTC derivative product. The proposal contained in the foregoing is not a complete description of the terms of a particular transaction and is subject to change without limitation.

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

A stepup note is a type of bond that has a fixed coupon rate that increases steps up over the life of the bond In this case the bond has a 6year matur... View full answer

Get step-by-step solutions from verified subject matter experts