You have created a Monte Carlo simulation to calculate the one-day, 99% VaR of a portfolio containing

Question:

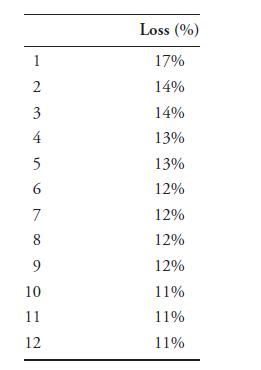

You have created a Monte Carlo simulation to calculate the one-day, 99% VaR of a portfolio containing a large number of options. In your simulation, you generate 1,000 sample one-day returns. The following table contains the 12 worst losses from your simulation. (Here, losses are represented as positive numbers, so 16% is a loss of 16% or a profit of −16%.)

What is the one-day 99% VaR? What is the one-day 99% expected shortfall?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Quantitative Financial Risk Management

ISBN: 9781119522201,9781119522263

1st Edition

Authors: Michael B. Miller

Question Posted: