Question: Jack Simms provides the following information: Additional information at 30 September 20*8 Stock was valued at 27,492. Wages owing amounted to 853.

Jack Simms provides the following information:

Additional information at 30 September 20*8

■ Stock was valued at £27,492.

■ Wages owing amounted to £853.

■ Rates paid in advance £1,270.

■ Jack had withdrawn goods from the business for personal use amounting to £2,500.

■ Commission receivable outstanding amounted to £180. This will be paid to Jack in December.

■ Provision for doubtful debts is to be maintained at 2.5% of debtors outstanding at the year-end.

■ Depreciation is to be provided for on fixed assets at the following rates:

– Premises 1% per annum using the straight line method

– Equipment 10% per annum using the straight line method

– Vehicles 40% using the reducing balance method.

Required

a) Prepare a trading and profit and loss account for the year ended 30 September 20*8.

b) Prepare a balance sheet at 30 September 20*8.

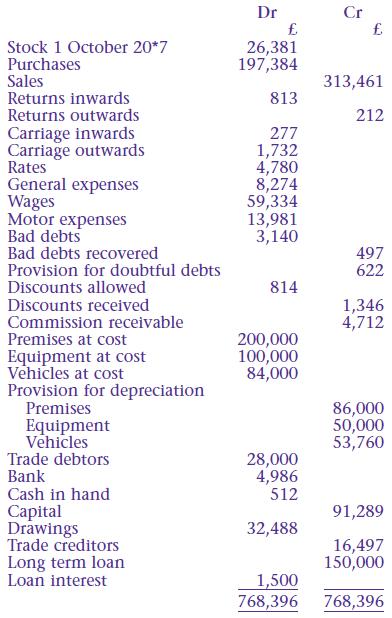

Stock 1 October 20*7 Purchases Sales Returns inwards Returns outwards Carriage inwards Carriage outwards Rates General expenses Wages Motor expenses Bad debts Bad debts recovered Provision for doubtful debts Discounts allowed Discounts received Commission receivable Premises at cost Equipment at cost Vehicles at cost Provision for depreciation Premises Equipment Vehicles Trade debtors Bank Cash in hand Capital Drawings Trade creditors Long term loan Loan interest Dr 26,381 197,384 813 277 1,732 4,780 8,274 59,334 13,981 3,140 814 200,000 100,000 84,000 28,000 4,986 512 32,488 1,500 768,396 Cr 313,461 212 497 622 1,346 4,712 86,000 50,000 53,760 91,289 16,497 150,000 768,396

Step by Step Solution

3.33 Rating (171 Votes )

There are 3 Steps involved in it

a Trading and Profit and Loss Account for the year ended 30 September 208 Particulars Sales 313461 L... View full answer

Get step-by-step solutions from verified subject matter experts