Question: Lets say you work in Illinois, and you want to figure out how much income tax you need to pay for the year. Here is

Let’s say you work in Illinois, and you want to figure out how much income tax you need to pay for the year. Here is what you know:

● Your hourly wage is $10.

● You have worked 1000 hours for the year

● You know Illinois’s income tax is 5%

Create a Java program using a class file called IllinoisTaxCalculator and create the following methods:

● Method to calculate annual income (hourly wage * number of hours you worked in a year)

● Method to calculate annual taxable income (annual income * tax)

● Method to calculate how much you owe in taxes hourly (hourly wage * tax)

● Method to calculate your net income (annual income - taxable income)

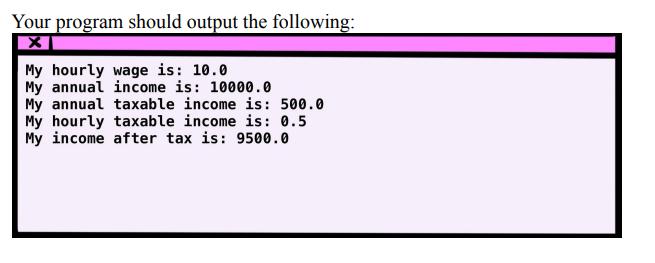

Your program should output the following: X My hourly wage is: 10.0 My annual income is: 10000.0 My annual taxable income is: 500.0 My hourly taxable income is: 0.5 My income after tax is: 9500.0

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Below is a Java program implementing the described functionality This progr... View full answer

Get step-by-step solutions from verified subject matter experts