Question: ABC, Inc. had the following partial balance sheet and partial annual income statement: The industry average DSO is 30 (based on a 365-day year). ABC

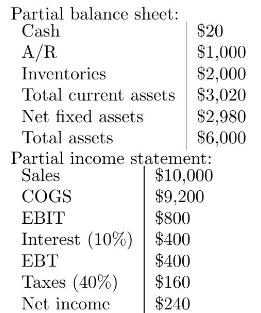

ABC, Inc. had the following partial balance sheet and partial annual income statement:

The industry average DSO is 30 (based on a 365-day year). ABC plans to change its credit policy so as to cause its DSO to equal the industry average. If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10 percent interest rate), what will ABC's debt ratio (Total debt / Total assets) be after the change in DSO is reflected in the balance sheet?

Partial balance sheet: Cash $20 A/R $1,000 Inventories $2,000 Total current assets $3,020 Net fixed assets $2,980 Total assets $6,000 Partial income statement: Sales $10,000 COGS $9,200 EBIT $800 Interest (10%) $400 EBT $400 Taxes (40%) $160 Net income $240

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts