Question: Refer to E17.3. How does your answer change if the toy division showed a loss from operations of $800,000 and if Hora experiences a gain

Refer to E17.3. How does your answer change if the toy division showed a loss from operations of $800,000 and if Hora experiences a gain on disposal of the toy division of $500,000? Show your calculations.

Data from E17.3

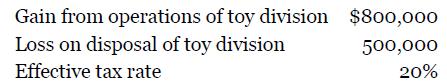

Hora Sporting Goods decided to sell its children’s toy division during 2019. The following relevant information is available. Use this information to determine the income (loss) from operations of the division and the income (loss) upon disposal of the division.

Gain from operations of toy division Loss on disposal of toy division Effective tax rate $800,000 500,000 20%

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

ANSWER If the toy division showed a loss from operations of 800000 and Hora experiences a gain on di... View full answer

Get step-by-step solutions from verified subject matter experts