Moulinex exports financing. On February 15, 2013, Moulinex, a French manufacturer of kitchen utensils, concluded a major

Question:

Moulinex exports financing. On February 15, 2013, Moulinex, a French manufacturer of kitchen utensils, concluded a major exports contract with British retailer Tesco. It expects export proceeds of 100 million pounds sterling (£) to be paid on August 15, 2013.

Financing of the export transaction can be arranged in three ways:

(1) through the French banking system in euros (€) at a yearly interest rate of 5 percent, (2) through the British banking system in sterling (£) at a yearly interest rate of 7 percent, and (3) through the Eurodollar market in US$ at a yearly interest rate of 3 percent.

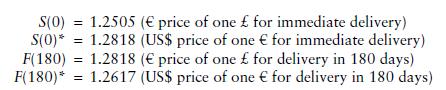

On February 15, 2013, exchange rates are quoted as follows:

a. What is the nature of Moulinex’s exposure to foreign exchange risk before financing is taken into account? How can it be hedged?

b. How can € or £ financing be combined with hedging? Which currency offers the cheaper financing?

c. What would be the rationale for financing exports to the United Kingdom in US$? What is/are the additional risk(s) incurred by Moulinex? Can they be hedged?

d. How should the transaction be financed?

Step by Step Answer:

International Corporate Finance Value Creation With Currency Derivatives In Global Capital Markets

ISBN: 9781119550464

2nd Edition

Authors: Laurent L. Jacque