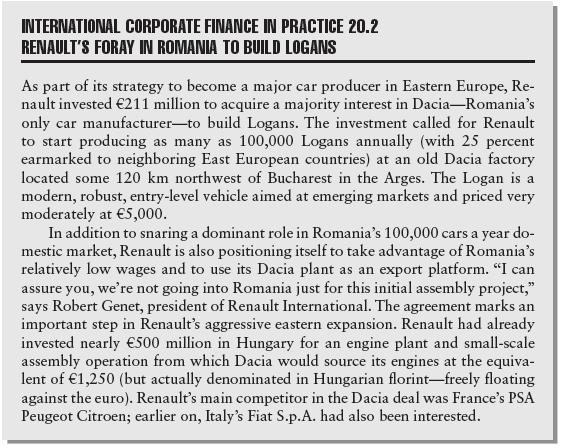

Refer to International Corporate Finance in Practice 20. 2 on page 560 relating the French carmaker Renaults

Question:

Refer to International Corporate Finance in Practice 20. 2 on page 560 relating the French carmaker Renault’s entry into the Romanian automobile market. The year is 2004 and Romania is barely gaining associated status in the European Union. Full membership is a couple of years away. As the chief investment analyst for Renault, you are charged with the preparation of an in-depth analysis of the investment proposal and making a go/

no-go recommendation.

a. Describe briefly your methodological approach to strategic investment of this nature. Be specific.

b. Map out the architecture of the project. Be specific as to the currency denomination of each cash flow and other environmental variables likely to impact cash flows.

c. Outline the different phases of the financial analysis leading to the Renault board of directors’ eventual decision.

d. Which valuation metric is most appropriate for Renault to reach a decision?

Data from Practice 20. 2

Step by Step Answer:

International Corporate Finance Value Creation With Currency Derivatives In Global Capital Markets

ISBN: 9781119550464

2nd Edition

Authors: Laurent L. Jacque