Writing a strangle (advanced). Assuming that Allied-Lyons would write a strangle as a speculative strategy, rather than

Question:

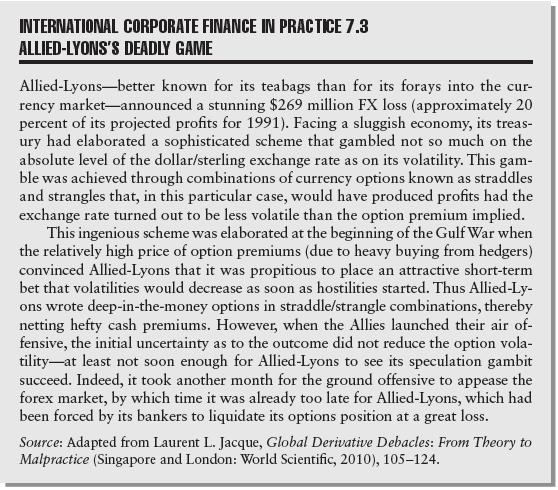

Writing a strangle (advanced). Assuming that Allied-Lyons would write a strangle as a speculative strategy, rather than a straddle as in problem 7, would you consider it to be more or less speculative? Prepare a single graph contrasting the two approaches, assuming that to create a strangle, Allied-Lyons was writing put and call options at strike prices of $1.20 and $1.30 and premiums of 1. 16 cents and 1. 04 cents, respectively.

Data from problem 7

Assuming that Allied-Lyons was relying on a straddle strategy (refer to International Corporate Finance in Practice 7. 3 for background information), explain graphically and numerically under what conditions Allied-Lyons could have generated speculative gains. For illustrative purposes, assume that on January 15, 1991, Allied-Lyons had written sterling calls and puts with identical strike prices of $1.25 = £1 and respective premiums of 2. 70 cents and 3. 13 cents per pound. Was Allied-Lyons bullish or bearish on the dollar? If the dollar were to rebound to 1. 50 by March 1, how and when should Allied-Lyons hedge its otherwise speculative position? How would your answer differ if the straddle used American rather than European options?

Data from International Corporate Finance in Practice 7. 3

Step by Step Answer:

International Corporate Finance Value Creation With Currency Derivatives In Global Capital Markets

ISBN: 9781119550464

2nd Edition

Authors: Laurent L. Jacque