Yen carry trade with investment in U.S. dollars/Icelandic krna. Louise is an associate with Charlemagne, a hedge

Question:

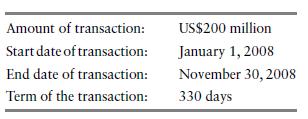

Yen carry trade with investment in U.S. dollars/Icelandic króna. Louise is an associate with Charlemagne, a hedge fund domiciled in Luxembourg, who is considering the following arbitrages:

Two funding alternatives from banks with loanable funds:

i. Deutsche Bank, Tokyo—Current interest rate on yen loans: 1. 875 percent per annum.

ii. JPMorgan Chase Bank NA, New York—Current US$ prime interest rate: 7. 25 percent per annum.

January 1, 2008, spot exchange rate: US$1 = ¥107.74.

Trader’s view of expected US$ versus yen spot exchange rate in 330 days:

US$1 = ¥107.74.

Two investing alternatives:

i. Citibank N.A., London, England, branch—Certificate of deposit, 330 days: 3. 56 percent per annum on Eurodollar deposits at LIBOR rate.

ii. Kaupthing Bank, Reykjavík, Iceland head office—Certificate of deposit: 14. 5 percent per annum.

January 1, 2008, US$ versus króna spot exchange rate: 64. 3 króna per US$.

Trader’s view of expected US$ versus króna spot exchange rate in 330 days: 64. 3 króna per US$.

Answer the following questions:

a. Draw two arbitrage diagrams—one for funding and one for investing—to engineer a yen carry trade transaction; show the transaction that maximizes the profit opportunity (or the one with minimum loss if you do not see a profitable opportunity), and clearly state the profit or loss on the engineered transaction.

b. If the yen exchange rate on November 30 is 96. 89 instead of 107. 74, how does that change the cost of the yen loan?

c. If the króna exchange rate on November 30 is 135 instead of 64. 3, how does that change the revenue of the króna investment?

d. What is the difference between a covered and an uncovered interest arbitrage transaction?

e. Summarize in bullet form five risks in this transaction—be as specific as you can be.

f. In 2008, how might an interest arbitrage trader’s worst nightmare have been realized?

(Prepared by Dr. Phil Ulhman.)

Step by Step Answer:

International Corporate Finance Value Creation With Currency Derivatives In Global Capital Markets

ISBN: 9781119550464

2nd Edition

Authors: Laurent L. Jacque