Mr. Arnett purchased 1,000 shares of Sure-Fire Limited, a public corporation, at $50 per share in 2011.

Question:

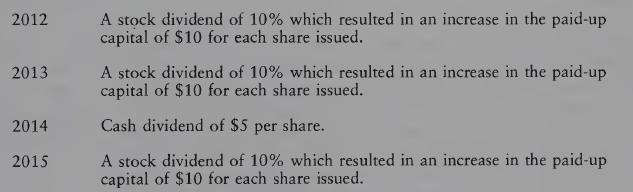

Mr. Arnett purchased 1,000 shares of Sure-Fire Limited, a public corporation, at $50 per share in 2011. Mr. Arnett received the following dividends subsequent to that time:

REQUIRED

Compute the taxable capital gain or allowable capital loss if Mr. Arnett sold 100 of the above shares in 2016 for $45 per share less brokerage fees of $100.

Transcribed Image Text:

2012 2013 2014 2015 A stock dividend of 10% which resulted in an increase in the paid-up capital of $10 for each share issued. A stock dividend of 10% which resulted in an increase in the paid-up capital of $10 for each share issued. Cash dividend of $5 per share. A stock dividend of 10% which resulted in an increase in the paid-up capital of $10 for each share issued.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

NOTE TO SOLUTION 2016 P of D ...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Ms. Plant decided to purchase shares in Schvantz Ltd., a public company. She purchased 800 shares at $25 per share plus brokerage of $690 on May 24, 1998. The following additional transactions took...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Suppose n is divisible by 6. Let (,P) be the space = {1,...,n} with the uniform probability P, let A be the event consisting of all even numbers, and let B be the event of all numbers divisible by...

-

Taylor Corporation has hired a marketing representative to sell the companys two products: Marvelous and Wonderful. The representatives total salary and fringe benefits are $8,000 monthly. The...

-

Marshall Industrial Supply offers terms of 2/10, n/30 to its wholesale customers. Marshalls cost of goods sold is 30% of sales. The company had the following transactions during October: Requirements...

-

Shiloh supplies equipment to the automotive and commercial vehicle markets and other industrial customers. It specializes in materials and designs that reduce vehicle weight and increase fuel...

-

Clapton Company manufactures custom guitars in a wide variety of styles. The following incomplete ledger accounts refer to transactions that are summarized for May: In addition, the following...

-

Question 2 Consider a monopsonist with the following relationship between wage and labor: and the following production function w= a+bL f(K, L) = ln(L) + In(K) (3) (4) 1. Write the short run profit...

-

Mr. Sung bought 1,000 shares of Norwood Ltd. at $10 per share on October 1, 2015. On December 15, 2015, Mr. Sung sold 1,000 shares at $5. On January 3, 2016, he bought 1,000 shares at $6. On November...

-

Consider the following transactions in the shares of Dachshund Airways Ltd: REQUIRED Compute the taxable capital gains, if any, on the 2009 and the 2016 sales. Date April 2004 March 2006 Aug. 2009...

-

On 1 February 2022, T Abella commenced business with $50 000 bank and a loan from Strate bank $20 000. On 3 February T Abella purchased the existing continuing business of T Longman for $48 000 and...

-

You are given the following quotation USD/CAN CAN/MYR GBP/BND MYR/BND USD/SGD Buying Selling 1.0010 1.0050 2.9960 2.9995 2.2420 2.3655 0.3450 1.2030 0.3650 1.2060 Compute the following. i. Cross-rate...

-

A meniscus lens with a refractive index of 1.490 has a center thickness of 4.5mm, a front radius of curvature of +44.55 mm, and back radius of curvature of +81.67 mm. Find the two surface powers and...

-

Module 05 Content You will expand the outline you wrote in Module 3 into a complete paper.There is no set length for the paper, though the average length is four or five pages. Citations are not...

-

Museum owns two of the three gemstones that were once lodged in the "Triforce Crown," a famous ancient relic, but not the crown itself, which has been lost for centuries. The third gemstone ("the...

-

1. Make a list of jobs that you think require really good problem solving skills. 2. What are some of the problems college students have to solve? 3. What are the steps you take to solve problems? 4....

-

Using the data from the preceding exercise, find the best predicted volume of a marble with a diameter of 1.50 cm. How does the result compare to the actual volume of 1.8 cm3? Find the regression...

-

a) Calculate the goodwill that was paid by Major Ltd on the acquisition of Minor Ltd. [10 marks] b) Prepare the consolidated statement of financial position for Major Ltd at 31 July 20X8. [30 marks]...

-

The following selected tax information has been taken from the books and records of your client, Mr. Weilman. Non-capital loss arising in 2008 $33,000 Net capital loss arising in 2009 25,000 Listed...

-

Mrs. Plant, age 47, is married and has three children: Amanda, age 24, Joan, age 17, and Courtney, age 16. Her own income for tax purposes of $60,000 includes employment income of $52,000. Amanda has...

-

Angelina and Romeo are the divorced parents of Maria, who is 10 years old. Angelina and Romeo have joint custody and Maria lives every second month with the other. Both Angelina and Romeo have...

-

Below I describe different examples of CSR and Cause Related Marketing. These concepts are often confused. Please match the real world example with the concept (CSR or CRM) that best describes it....

-

What philosophical perspectives, such as virtue ethics and existentialism, shed light on the ethical dimensions of emotional intelligence and its role in promoting human flourishing and well-being in...

-

BUS 70/Pick four different products. For each of those products select two different types of media that would be appropriate for that particular product. Be sure to explain why each type of media is...

Study smarter with the SolutionInn App