Mr. Clark reported the following income for tax purposes in 2015: Included in the employment income computation

Question:

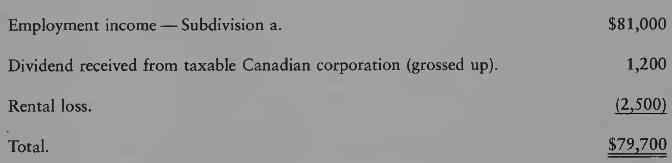

Mr. Clark reported the following income for tax purposes in 2015:

Included in the employment income computation was a deduction for a current contribution to a registered pension plan of $3,200. His employer reported a PA on his T4 for 2015 of $10,000. Mr. Clark made $5,000 of tax-deductible support payments to his former spouse in 2015.

REQUIRED

Calculate the maximum RRSP contribution that Mr. Clark can deduct as an annual contribution in 2016, as determined under the definition of “RRSP deduction limit”, and advise Mr. Clark as to when he can make his contribution. Is there any other advice that you might want to give Mr. Clark in 2016 regarding his contributions?

Step by Step Answer:

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett