Windemere Limited is a Canadian-controlled private corporation founded 12 years ago by Mr. White who holds all

Question:

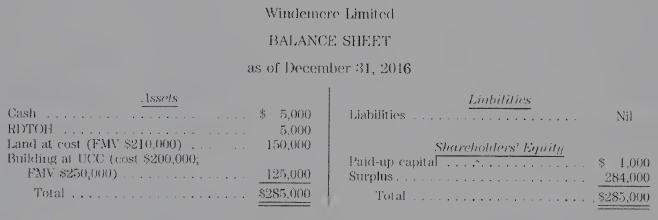

Windemere Limited is a Canadian-controlled private corporation founded 12 years ago by Mr. White who holds all of the shares which he purchased at that time from the company for $1,000. As of December 31, 2016, its tax balance sheet appears as follows:

The surplus accounts include $50,000 in the capital dividend account. The assets are to be liquidated and the proceeds are to be distributed to Mr. White on the winding-up beginning on January 1, 2017.

REQUIRED

(1) Compute the amount available for distribution to the shareholder assuming the company pays corporate tax at the overall rate of 15% on the first $500,000 of active business income and 40% on all other income, before the additional refundable tax of 10%%.

(2) Determine the components of the distribution to the shareholder.

(3) Compute the taxable capital gain or allowable capital loss on the disposition of Mr. White’s shares.

Step by Step Answer:

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett