ABC manufacturing entity (sole trader) has provided you with the following information at the year ended 31

Question:

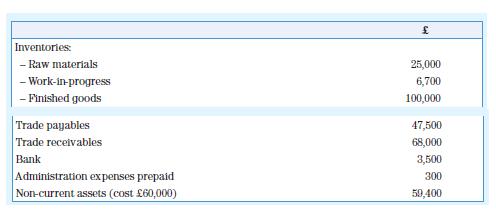

ABC manufacturing entity (sole trader) has provided you with the following information at the year ended 31 July 20X4:

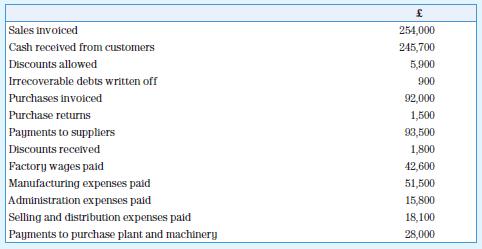

During the year ended 31 July 20X5 the following transactions took place:

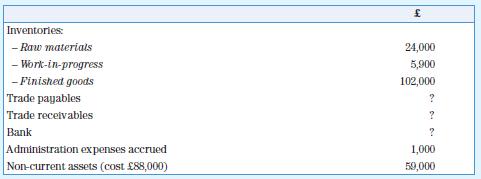

ABC informed you that the balances at 31 July 20X5 were as follows:

Additional information

1. Depreciation on non-current assets should be apportioned between manufacturing (60 per cent), administration (25 per cent) and selling and distribution (15 per cent).

2. Discounts allowed and irrecoverable debts are regarded as selling expenses.

3. Discounts received should be regarded as administration expenses.

Required

a. Compute the balances on the trade receivables account, the trade payables account and the bank account at 31 July 20X5 (the ledger accounts should be provided).

b. Prepare the manufacturing account and the statement of profit or loss for the company for the year ended 31 July 20X5.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas