Anna and Thomas are in partnership sharing profits and losses equally. The partnership agreement provides for an

Question:

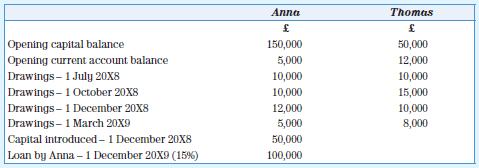

Anna and Thomas are in partnership sharing profits and losses equally. The partnership agreement provides for an annual salary to Anna of £57,000. It also provides for interest on capital of 10 per cent per annum and interest on drawings of 12 per cent per annum.

The following additional information relates to the accounting year ending 30 June 20X9:

The profit for the year shown in the statement of profit or loss for the year ended 30 June 20X9 was £180,000.

Required

Prepare the following accounts:

a. Appropriation account

b. Capital accounts

c. Current accounts

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas

Question Posted: