Blackburn, Percy and Nelson are in partnership, sharing profits equally. On 1 January 20X9 Nelson retired and

Question:

Blackburn, Percy and Nelson are in partnership, sharing profits equally. On 1 January 20X9 Nelson retired and Logan was admitted as a partner. Nelson has agreed to leave the amounts owing to her in the business as a loan until 31 December 20X9. Logan is to contribute £6,000 as capital. Future profits are to be shared: Blackburn one-half and Percy and Logan one-quarter each.

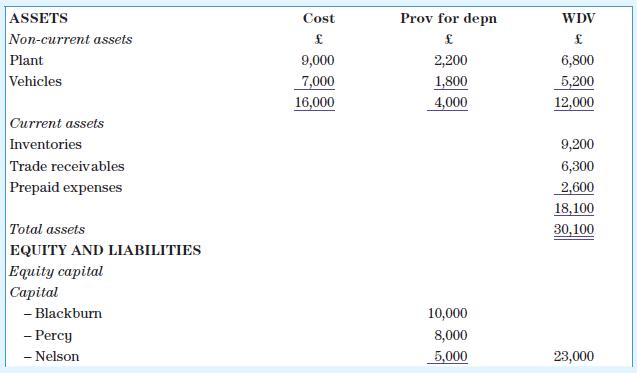

A goodwill account is to be opened and kept in the books. The goodwill should be valued at the difference between the capitalized value of the estimated super profits for the forthcoming year and the net asset value of the partnership at 31 December 20X8 after revaluing the assets. The capitalized value of the expected super profits is to be computed using the price–earnings ratio, which for this type of business is estimated as 8. The super profits are after deducting notional partners’ salaries but not interest on capital. The profit for 20X9 is estimated as £48,750 and it is thought that the partners could each earn £15,000 a year if they were employed elsewhere. The statement of financial position at 31 December 20X8 was as follows:

It was decided that inventory is to be valued at £8,000 and vehicles at £6,700. Of the trade receivables £900 are considered doubtful debts.

Required

Show the ledger entries relating to the above revaluation and change of partners.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas