Matthew, Mark and Luke were in partnership sharing profits and losses in the ratio 5 : 3

Question:

Matthew, Mark and Luke were in partnership sharing profits and losses in the ratio 5 : 3 : 2, financial statements being made up annually to 30 June. Fixed capital accounts were to bear interest at the rate of 5 per cent per annum, but no interest was to be allowed or received on current accounts or drawings. Any balance on current accounts was to be paid at each year end.

Luke left the partnership on 30 September 20X8, but agreed to leave his money in the business until a new partner was admitted, provided interest at 5 per cent was paid on all amounts due to him.

John was admitted to the partnership on 1 January 20X9, providing capital of £2,000. It was agreed that the new profit-sharing ratio be Matthew 5, Mark 4, John 1, but Mark was to guarantee John an income of £3,000 per annum in addition to his interest on capital. At 1 July 20X8 each partner had a fixed capital of £4,000.

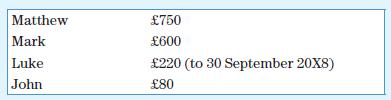

Drawings during the year 20X8/20X9 were as follows:

The profit for the year to 30 June 20X9 was £20,000, which may be assumed to have accrued evenly over that period.

You are required to show:

a. The appropriation account;

b. The partners’ current accounts for the year ended 30 June 20X9.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas