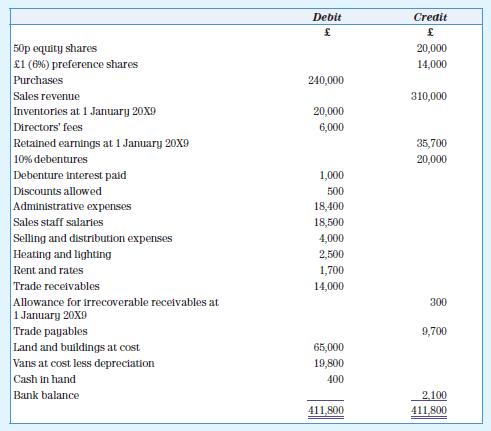

The Cirrus Co. Plc has the following balances on its books at 31 December 20X9. The following

Question:

The Cirrus Co. Plc has the following balances on its books at 31 December 20X9.

The following information is also given:

1. The inventory at 31 December 20X9 has been valued at £32,000. Further investigation reveals that this includes some items originally purchased for £3,000, which have been in inventory for a long time. They need modification, probably costing about £600, after which it is hoped they will be saleable for between £3,200 and £3,500. Other items, included in the total at their cost price of £5,000, have been sent to an agent and are still at his premises awaiting sale. It cost £200 for transport and insurance to get them to the agent’s premises and this amount is included in the selling and distribution expenses.

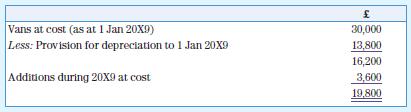

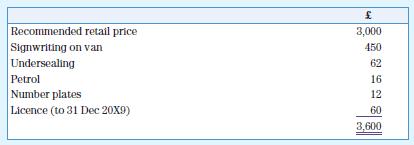

2. The balance on the vans account (£19,800) is made up as follows:

Depreciation is provided at 25 per cent per annum on the diminishing balance method. The addition during the year was invoiced as follows

3. The directors, having sought the advice of an independent valuer, wish to revalue the land and buildings at £80,000.

4. The directors wish to make an allowance for irrecoverable receivables of 2.5 per cent of the balance of trade receivables at 31 December 20X9.

5. Rates prepaid at 31 December 20X9 amount to £400, and sales staff salaries owing at that date were £443.

6. The directors have proposed an equity dividend of 5p per share and the 6 per cent preference dividend.

7. Ignore value added tax (VAT).

Required

a. Explain carefully the reason for the adjustments you have made in respect of points 1, 2 and 3 above.

b. Prepare a statement of comprehensive income for the year ended 31 December 20X9, a statement of financial position as at that date and the statement of changes in equity for the year.

c. Briefly distinguish between your treatment of debenture interest and proposed dividends.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas