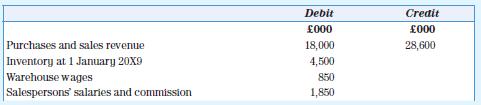

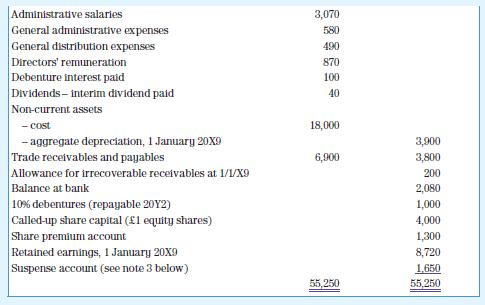

The trial balance of Harmonica Ltd at 31 December 20X9 is given below. Additional information 1. Closing

Question:

The trial balance of Harmonica Ltd at 31 December 20X9 is given below.

Additional information

1. Closing inventory amounted to £5m.

2. A review of the trade receivables total of £6.9m showed that it was necessary to write off receivables totalling £0.4m, and that the allowance for irrecoverable receivables should be adjusted to 2 per cent of the remaining trade receivables.

3. Two transactions have been entered in the company’s cash record and transferred to the suspense account shown in the trial balance. They are:

a. The receipt of £1.5m from the issue of 500,000 £1 equity shares at a premium of £2 per share.

b. The sale of some surplus plant. The plant had cost £1m and had a written-down value of £100,000. The sale proceeds of £150,000 have been credited to the suspense account but no other entries have been made.

4. Depreciation should be charged at 10 per cent per annum on cost at the end of the year and allocated 70 per cent to distribution costs and 30 per cent to administration.

5. The directors propose a final dividend of 4 pence per share on the shares in issue at the end of the year.

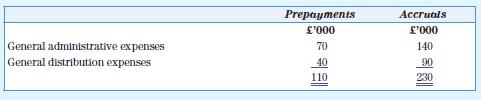

6. Accruals and prepayments still to be accounted for are:

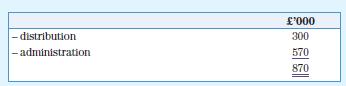

7. Directors’ remuneration is to be analysed between distribution costs and administrative expenses as follows:

8. Ignore taxation.

Required

Prepare the company’s statement of comprehensive income and statement of changes in equity for the year ended 31 December 20X9, and statement of financial position as at 31 December 20X9 in a form suitable for publication. Notes to the financial statements are not required.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas