Lowest Cost Corporation uses target costing to aid in the final decision to release new products to

Question:

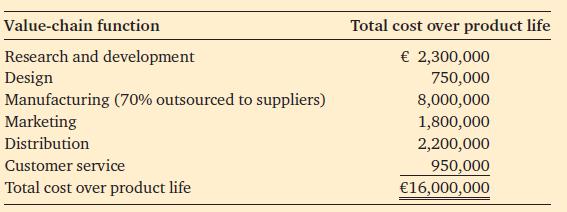

Lowest Cost Corporation uses target costing to aid in the final decision to release new products to production. A new product is being evaluated. Market research has surveyed the potential market for this product and believes that its unique features will generate a total demand over the product’s life of 70,000 units at an average price of €360. The target costing team has members from market research, design, accounting and production engineering departments. The team has worked closely with key customers and suppliers. A value analysis of the product has determined that the total cost for the various value-chain functions using the existing process technology are as follows:

Management has a target contribution to profit percentage of 40 per cent of sales. This contribution provides sufficient funds to cover corporate support costs, taxes and a reasonable profit.

1. Should the new product be released to production? Explain.

2. Approximately 70 per cent of manufacturing costs for this product consists of materials and parts that are purchased from suppliers. Key suppliers on the target-costing team have suggested process improvements that will reduce supplier cost by 20 per cent. Should the new product be released to production? Explain.

3. New process technology can be purchased at a cost of €220,000 that will reduce nonoutsourced manufacturing costs by 25 per cent. Assuming the supplier’s process improvements and new process technology are implemented, should the new product be released to production? Explain.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg