Penski Precision Tooling applies factory overhead using machine hours and number of component parts as cost-allocation bases.

Question:

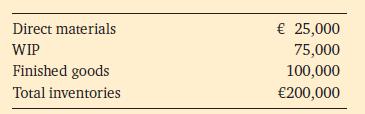

Penski Precision Tooling applies factory overhead using machine hours and number of component parts as cost-allocation bases. In 20X0, actual factory overhead incurred was €125,000 and applied factory overhead was €135,000. Before disposition of underapplied or overapplied factory overhead, the cost of goods sold was €525,000, gross profit was €60,000, and ending inventories were as follows:

1. Was factory overhead overapplied or underapplied? By how much?

2. Assume that Penski writes off overapplied or underapplied factory overhead as an adjustment to cost of goods sold. Compute adjusted gross profit.

3. Assume that Penski prorates overapplied or underapplied factory overhead based on end-of-the-year unadjusted balances. Compute adjusted gross profit.

4. Assume that actual factory overhead was €140,000 instead of €125,000, and that Penski writes off overapplied or underapplied factory overhead as an adjustment to cost of goods sold. Compute adjusted gross profit.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg