The central issue in this case concerns product pricing. The analysis requires the estimation of appropriate costs

Question:

The central issue in this case concerns product pricing. The analysis requires the estimation of appropriate costs and assessing price-demand information using past sales data.

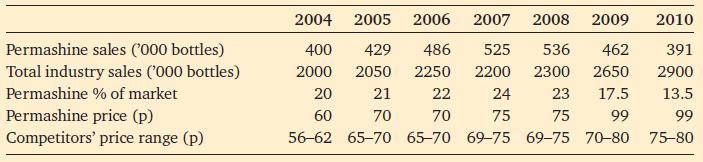

Permaclean Products is an old-established firm, located in Dunstable, manufacturing a comprehensive range of domestic cleaning materials. It has a sound reputation and a well-known brand name which has made it a market leader in a wide range of products designed for home use. Although Permaclean has several competitors, the total sales of each are small in comparison with those of Permaclean, mainly because none offers such a complete product range. In 2009 the price of one of Permaclean’s major products, Permashine, was raised from 75p per bottle to 99p when the product was repackaged in a newly designed bottle; however, the contents were identical to the previous pack, both in formulation and quantity. During the following two years sales fell by 27 per cent. At 75p per bottle Permashine had been competitively priced but when its price was increased manufacturers of similar products had not followed. In the period from 2007 to 2010 the price of competing products had been raised by only 5p.

Prices were fixed once a year, to come into force on 1 February, before the annual peak demand which occurred in the spring. In January 2011, John Williams, the marketing manager, met with Andrew Dutton, the chief accountant, to review the company’s pricing policy for the coming year.

Permashine

Permashine is a proprietary cleaning product for bathrooms and in 2008 had accounted for over 10 per cent of the company’s sales. Although there are a variety of competing products on the market, Permashine has special properties which make it especially suitable for cleaning baths made of acrylic materials. Such baths are becoming increasingly common, but great care has to be taken to avoid scratching them when they are being cleaned. Permashine contains no abrasive materials yet is able to clean acrylic surfaces with great efficiency, giving a surface shine that is very durable. No competing product appears to have this combination of advantages.

The process used in the manufacture of Permashine involves a hazardous chemical reaction that has to be precisely controlled. Production therefore takes place in a separate building on the same site as the main factory where the other products are made, but some distance from it. This production unit, which was constructed in 2003 for safety reasons, is not capable of being adapted for the manufacture of other Permaclean products without substantial expenditure. Although the manufacture of Permashine is potentially hazardous, no serious accidents have occurred during the 15 years in which it has been produced and the final product is itself completely harmless.

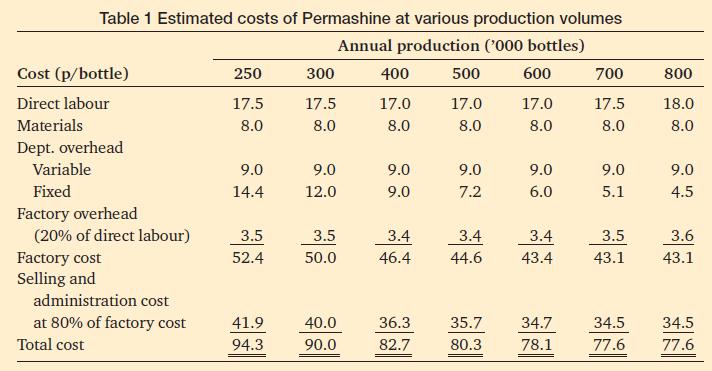

In early 2010, Andrew Dutton had installed an improved cost accounting system which allowed product costs to be determined and product profitability to be reviewed. With regard to Permashine, this took into account the new packaging costs, as well as the overhead costs that were separately attributable to the production unit. His analysis, shown in Table 1, indicated that the total cost of Permashine was greater than the current selling price of 75p. As a result, at the annual pricing review in 2009 the selling price was increased to 99p.

Table 1,

Although total industry sales continued to rise during 2009 and 2010, Permashine suffered a reduction in both its market share and its total sales, as shown in Table 2.

Table 2

The 2011 pricing review

Both Mr Williams and Mr Dutton were concerned to improve the profitability of Permashine, as it was one of the company’s major products. Mr Williams had joined the company in 2003 and had introduced a number of changes in the firm’s marketing methods. One of his major successes had been his decision to replace wholesalers with a team of salaried sales representatives who sold the company’s full product range direct to retailers. Mr Dutton had been appointed in 2007, following the retirement of the previous chief accountant and had been responsible for installing a modern computer-based accounting system.

Mr Williams pressed for a return to the previous price of 75p for Permashine; at this price he was confident that the market share of the product could be increased to 20 per cent in 2011. He thought that total industry sales would continue to increase to at least 3 million bottles in 2011, and that Permashine was capable of regaining its previous position, provided that it was competitively priced. Because Permaclean had a modern production facility and a manufacturing output greater than any competitor, he was confident that factory production costs were the lowest in the industry. He therefore supported a policy of reducing the price so that other firms would find it uneconomic to continue to compete.

Mr Williams was convinced that sales would continue to fall if the price were to be maintained at 99p, although he believed that there would always be a premium market for Permashine because of its unique qualities. He thought that annual sales were unlikely to fall below 250 000 bottles even at the current price.

Mr Dutton replied that he was well aware of the problems being experienced in selling the higher-priced product. Nevertheless, his analysis showed that the 99p price covered the costs of the product, even at the lowest volume envisaged. If the price were reduced to 75p costs would fail to be covered, even if sales volume rose to the 800 000 bottles which represented the maximum practical capacity of the plant. He referred to his detailed costings (Table 1) to support his argument. These figures, he stated, were based on actual data from past years; where data were not available, he had made what he regarded as realistic assumptions.

Question

What price would you recommend for Permashine? Support your recommendation with detailed calculations, making the underlying assumptions on which your analysis is based as clear as possible.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg