The Reliable Insurance Company processes a variety of insurance claims for losses, accidents, thefts and so on.

Question:

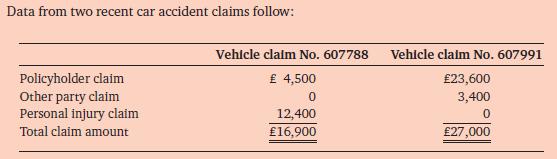

The Reliable Insurance Company processes a variety of insurance claims for losses, accidents, thefts and so on. Account analysis using one cost driver has estimated the variable cost of processing the claims for each automobile accident at 0.5 per cent (.005) of the monetary value of all claims related to a particular accident. This estimate seemed reasonable because highcost claims often involve more analysis before settlement. To control processing costs better, however, Reliable conducted an activity analysis of claims processing. The analysis suggested that there are three main cost drivers for the costs of processing claims for car accidents. The drivers and cost behaviour are as follows:

0.2% of Reliable Insurance policyholders property claims.

+ 0.6% of other parties' property claims.

+ 0.8% of total personal injury claims.

1. Estimate the cost of processing each claim using data from

(a). The single-cost-driver analysis and

(b). The three-cost-driver analysis.

2. How would you recommend that Reliable Insurance estimate the cost of processing claims?

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg