The Tokyo division of Kaycee Toy Company manufactures units of the game Shogi and sells them in

Question:

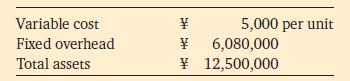

The Tokyo division of Kaycee Toy Company manufactures units of the game Shogi and sells them in the Japanese market for ¥7,200 each. The following data are from the Tokyo division’s 20X8 budget:

Kaycee has instructed the Tokyo division to budget a rate of return on total assets (before taxes) of 20 per cent.

1. Suppose the Tokyo division expects to sell 3,400 games during 20X8.

(a). What rate of return will be earned on total assets?

(b). What would be the expected capital turnover?

(c). What would be the return on sales?

2. The Tokyo division is considering adjustments in the budget to reach the desired 20 per cent rate of return on total assets.

(a). How many units must be sold to obtain the desired return if no other part of the budget is changed?

(b). Suppose sales cannot be increased beyond 3,400 units. How much must total assets be reduced to obtain the desired return? Assume that for every ¥1,000 decrease in total assets, fixed costs decrease by ¥100.

3. Assume that only 2,400 units can be sold in the Japanese market. However, another 1,400 units can be sold to the European marketing division of Kaycee. The Tokyo manager has offered to sell the 1,400 units for ¥6,700 each. The European marketing division manager has countered with an offer to pay ¥6,200 per unit, claiming that she can subcontract production to an Italian producer at a cost equivalent to ¥6,200. The Tokyo manager knows that if his production falls to 2,400 units, he could eliminate some assets, reducing total assets to ¥10 million and annual fixed overhead to ¥4.9 million. Should the Tokyo manager sell for ¥6,200 per unit? Support your answer with the relevant computations. Ignore the effects of income taxes and import duties.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg