This is a general case on the design of a management and cost accounting system for a

Question:

This is a general case on the design of a management and cost accounting system for a firm operating in a high-tech environment. It provides an opportunity for a broad discussion not only of the appropriateness of particular accounting techniques but also of the need to consider strategic, behavioural and organisational factors.

Introduction

Jack Watson, an electrical engineer, established Electronic Boards plc as a ‘one-man’ company in the early 1980s. From small beginnings, the company earned a reputation for the quality and reliability of its products and grew rapidly and consistently until, by 2011, it employed over 200 people and had achieved a turnover of £56 million and a profit after tax of £4.1 million.

In addition to Jack Watson, the managing director, the board consists of a production director, a research director and a marketing director.

Market circumstances

The company produces customized batches of electronic circuit boards for approximately 15 major customers in the defense, computer, electrical goods and automotive industries.

The market is highly competitive in respect of both price and quality. Market price has fallen steadily in recent years. In addition to several other independent firms both from the UK and Far East, many of their larger customers have in-house facilities for the production of circuit boards. These latter firms deliberately subcontract a portion of their circuit board requirements for strategic reasons. In a recession they can cease or reduce their subcontracting and bring the work in-house, so stabilising their own employment levels.

Operational circumstances

The production process for circuit boards is complex, multi-stage and highly automated. Production flows continuously through the various processes and any hold-up quickly affects the flow of work at all production stages. Experience has shown that a proportion of the final output contains faults and has to be scrapped. These scrap levels typically vary between 10 per cent and 25 per cent of good output, a considerable learning effect is apparent and the yield on repeat orders is usually significantly improved. At present, faulty products are identified only on completion, although action has been instigated (in the form of an investigative working party) to achieve an earlier identification of faults. Orders are obtained in three ways:

1. By written tender for large contracts (approximately 40 per cent of business).

2. By telephone quotation for small orders (approximately 20 per cent of business) – a price is normally quoted to the caller during the call.

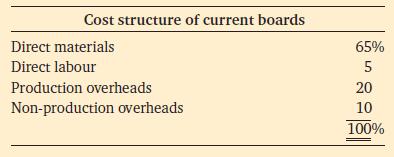

3. By repeat orders (approximately 40 per cent of business). Prices are calculated by estimating the direct material cost of an order and adding on an allowance for all other costs and profit. This allowance is based on the previous year’s direct material cost to sales margin. In recent years the cost structure of the firm’s output has been as follows:

Direct materials are by far the major cost component and this importance is reflected in the high levels of materials stock which are held by the company.

Financial information

It is generally accepted by the senior members of management that the development of a management accounting system has been neglected. This has been attributed mainly to the dismissive attitude of line management to accountants. Encapsulating this view was the comment of one senior manager, ‘they are “bean-counters” who know nothing about the electronics industry, the problems we face and the decisions we have to take’. The consistent success of the company in the absence of any management accounting system has reinforced this type of attitude among managers and directors in the company. No qualified accountants have been appointed to the board, and until 2010 only one qualified accountant was employed by the company. His prime responsibility was the preparation of statutory financial accounting statements for shareholders. In addition, however, since 2008 a half-yearly company profit and loss account and balance sheet has been prepared for the board.

No product costing system has been in operation. For financial statement preparation, work in progress is simply valued at an estimate of its direct material content cost and finished goods stock is valued at a discounted selling price (using the previous year’s gross profit percentage).

However, some managers have complained about their lack of knowledge of unit production costs and about their inability to pinpoint which contracts or types of work have been profitable for the company.

Budgets are no longer prepared. Attempts were made to produce annual budgets in 2006 and 2007 but the firm’s accountant experienced great difficulty in obtaining reliable estimates from line management. His lack of authority within the firm and the absence of a finance director to provide support rendered his requests for information ineffective. Consequently, acceptance of the budgets which he prepared was not forthcoming. They were quickly viewed as unrealistic by management and after a few months ignored.

Capital budgeting decisions have been based upon the need for the firm to remain at the forefront of production technology. If new equipment became available which would improve the firm’s product quality, it was usually purchased and then funds were ‘found’ to finance it. This had often led to the company having unexpected overdrafts and high bank charges and interest expenses.

Recession

In 2011 the firm experienced its first recession. Market share fell, sales dropped to ₤21.5 million, a loss of ₤1.7 million was made and the company’s liquidity suffered considerably. The market decline was expected to continue in 2012 and the managing director of Electronic Boards plc sought ways of alleviating the effects of the recession on the company’s financial performance. He found, however, that the lack of management accounting information hampered him in pinpointing problem areas and in identifying cost-reduction possibilities. Consequently, he approached a firm of management consultants to provide a blueprint for the development of a management accounting system over the next two years.

Question

Prepare a blueprint for the board of Electronic Boards plc outlining the main factors which it should consider in establishing a useful management accounting function within the company.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg