Virgin Trains (VT) has included a cafeteria car on the passenger train it operates. Yearly operations of

Question:

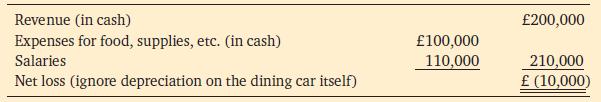

Virgin Trains (VT) has included a cafeteria car on the passenger train it operates. Yearly operations of the cafeteria car have shown a consistent loss, which is expected to persist, as follows:

The Auto-Vend Company has offered to sell automatic vending machines to VT for £22,000, less a £3,000 trade-in allowance on old equipment (which is carried at £3,000 book value and which can be sold outright for £3,000 cash) now used in the cafeteria-car operation. The useful life of the vending equipment is estimated at 10 years, with zero scrap value. Experience elsewhere has led executives to predict that the equipment will serve 50 per cent more food than the dining car, but prices will be 50 per cent less, so the new revenue will probably be £150,000. The variety and mix of food sold are expected to be the same as for the cafeteria car. A catering company will completely service and supply food and beverages for the machines, paying 10 per cent of revenue to VT and bearing all costs of food, repairs and so on. All dining-car employees will be discharged immediately.

Their termination pay will total £35,000. However, an attendant who has some general knowledge of vending machines will be needed for one shift per day. The annual cost to VT for the attendant will be £13,000.

For political and other reasons, the railroad will definitely not abandon its food service. The old equipment will have zero scrap value at the end of 10 years. Using the preceding data, compute the following. Label computations. Ignore income taxes.

1. Use the NPV method to analyze the incremental investment. Assume a minimum desired rate of return of 10 per cent. For this problem, assume that the PV of £1 at 10 per cent to be received at the end of 10 years is £.40 and that the PV of an annuity of £1 at 10 per cent for 10 years is £6.00.

2. What would be the minimum amount of annual revenue that VT would have to receive from the catering company to justify making the investment? Show computations.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg