Question: Absorption and variable costing income statements (Learning Objective 7) (Appendix) Game Source manufactures video games, which it sells for $40 each. The company uses the

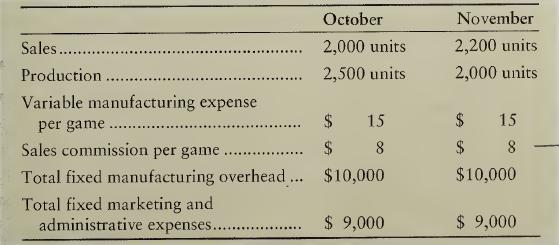

Absorption and variable costing income statements (Learning Objective 7) (Appendix) Game Source manufactures video games, which it sells for $40 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manu¬ facturing overhead rate based on the actual number of games produced that month. All costs and production levels are exactly as planned. The following data are from Game Source’s first two months in business during 2007:

Requirements 1. Compute the product cost per game produced under absorption costing and under variable costing. Do this first for October and then for November.

2. Prepare separate monthly income statements for October and for November, using:

a. Absorption costing.

b. Variable costing.

3. Is operating income higher under absorption costing or variable costing in October? In November? Explain the pattern of differences in operating income based on absorption costing versus variable costing.

Sales........... Production. Variable manufacturing expense per game..... Sales commission per game Total fixed manufacturing overhead... Total fixed marketing and administrative expenses..... October November 2,000 units 2,200 units 2,500 units 2,000 units 15 $ 15 $ 8 $ 8 $10,000 $10,000 $ 9,000 $ 9,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts