Question: A partial amortization schedule for a five-year note payable that Mercury Co. issued on January 1, Year 1, is shown next: Required a. What rate

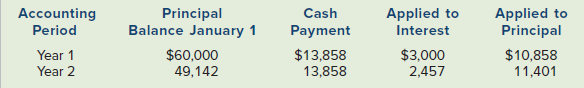

A partial amortization schedule for a five-year note payable that Mercury Co. issued on January 1, Year 1, is shown next:

Required

a. What rate of interest is Mercury Co. paying on the note?

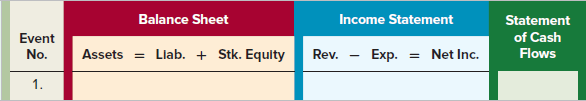

b. Using a financial statements model like the one shown next, record the appropriate amounts for the following two events:

(1) January 1, Year 1, issue of the note payable

(2) December 31, Year 2, payment on the note payable

c. If the company earned $75,000 cash revenue and paid $32,000 in cash expenses in addition to the interest in Year 1, what is the amount of each of the following?

(1) Net income for Year 1

(2) Cash flow from operating activities for Year 1

(3) Cash flow from financing activities for Year 1

d. What is the amount of interest expense on this loan for Year 3?

Applied to Interest Applied to Principal Accounting Period Year 1 Year 2 Principal Balance January 1 Cash Payment $13,858 13,858 $10,858 11,401 $3,000 2,457 $60,000 49,142 Balance Sheet Income Statement Statement Event No. Assets = Llab. + Stk. Equlty Rev. - Exp. of Cash Flows = Net Inc. 1.

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

a 3000 60000 05 or 5 b Effect of Transactions on Financial Statements Balance S... View full answer

Get step-by-step solutions from verified subject matter experts