Advance Auto Parts, Inc. is . . . a leading automotive aftermarket parts provider in North America.

Question:

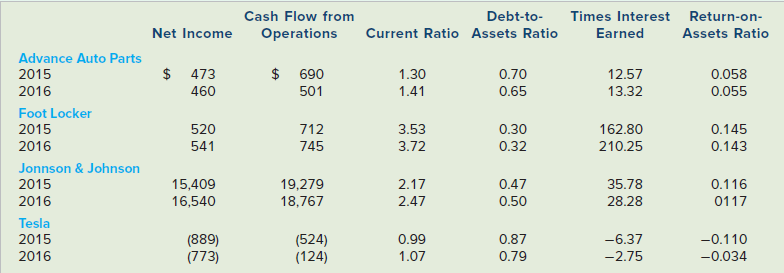

Advance Auto Parts, Inc. is “. . . a leading automotive aftermarket parts provider in North America. . . . We were founded in 1929 as Advance Stores Company. . . . As of January 2, 2016 . . . we operated 5,171 total stores and 122 branches primarily under the trade names ‘Advance Auto Parts,’ ‘ Autopart International,’ ‘Carquest,’ and ‘Worldpac.’ ” Foot Locker, Inc. “. . . incorporated under the laws of the State of New York in 1989, is a leading global retailer of athletically inspired shoes and apparel, operating 3,383 primarily mall-based stores in the United States, Canada, Europe, Australia, and New Zealand as of January 30, 2016.” Johnson & Johnson, Inc. “. . . and its subsidiaries have approximately 127,100 employees worldwide engaged in the research and development, manufacture and sale of a broad range of products in the health care field. . . .

The Company’s primary focus is products related to human health and wellbeing. Johnson & Johnson was incorporated in the State of New Jersey in 1887.” Tesla, Inc.: “We design, develop, manufacture and sell high-performance fully electric vehicles, and energy storage systems, as well as install, operate and maintain solar and energy storage products. We are the world’s only vertically integrated energy company, offering end-to-end clean energy products, including generation, storage and consumption.” Each company received a different rating from Standard & Poor’s (S&P). In descending order, the ratings for these companies were AAA, BBB−, BB+, and B−. These rating are as of March 16, 2017. All dollar amounts are in millions.

Required

Determine which credit rating was assigned to which company. Write a memorandum explaining the

rationale for your decisions. The logic you present to support your conclusions is more important than

correctly matching the companies with their ratings.

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds