Brice Co. completed the following transactions in Year 1, the first year of operation. 1. Issued 40,000

Question:

Brice Co. completed the following transactions in Year 1, the first year of operation.

1. Issued 40,000 shares of no-par common stock for $10 per share.

2. Issued 8,000 shares of $20 par, 6 percent, preferred stock for $20 per share.

3. Paid a cash dividend of $9,600 to preferred shareholders.

4. Issued a 10 percent stock dividend on no-par common stock. The market value at the dividend declaration date was $12 per share.

5. Later that year, issued a 2-for-1 split on the shares of outstanding common stock. The market price of the stock at that time was $50 per share.

6. Produced $140,000 of cash revenues and incurred $72,000 of cash operating expenses.

7. Closed the revenue, expense, and dividend accounts to retained earnings.

Required

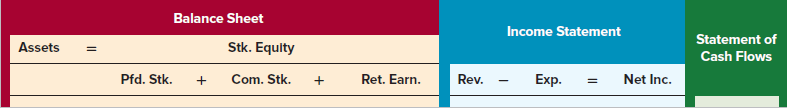

a. Record each of these events in a horizontal statements model like the following one. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Use NA to indicate that an element is not affected by the event.

b. Prepare the stockholders’ equity section of the balance sheet at the end of Year 1. (Include all necessary information.)

c. Theoretically, what is the market value of the common stock after the stock split?

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds