Fly-In Service, Inc., operates leased amphibious aircraft and docking facilities, equipping the firm to transport campers and

Question:

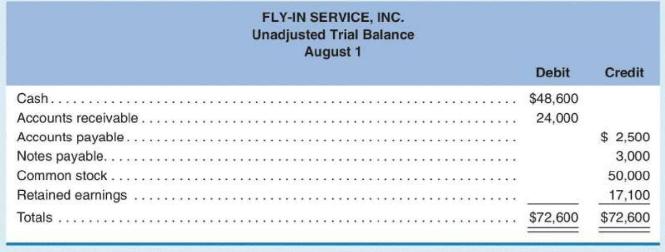

Fly-In Service, Inc., operates leased amphibious aircraft and docking facilities, equipping the firm to transport campers and hunters from Vancouver, Canada, to outpost camps owned by various resorts. On August 1 , the firm's trial balance was as follows:

During the month of August, the following transactions occurred:

1 Paid August rental cost for aircraft, dockage, and dockside office, \(\$ 5,000\).

2 Paid insurance premium for August, \(\$ 1,200\).

3 Paid for August advertising in various sports magazines, \(\$ 1,000\).

4 Rendered fly-in services for various groups for cash, \(\$ 15,500\).

5 Billed the Canadian Ministry of Natural Resources for services in transporting mapping personnel, \(\$ 4,400\).

6 Received \(\$ 17,400\) on account from clients.

7 Paid \(\$ 2,100\) on accounts payable.

8 Billed various clients for services, \(\$ 16,400\).

9 Paid interest on a note payable for August, \(\$ 25\).

10 Paid August wages, \(\$ 12,800\).

11 Received invoice for the cost of fuel used during August, \(\$ 3,800\).

12 Paid a cash dividend, \(\$ 5,000\).

Required

a. Set up accounts for each item in the August I trial balance and enter the beginning balances. Also provide accounts for the following items: Service Fees Earned, Wage Expense, Advertising Expense, Rent Expense, Fuel Expense, Insurance Expense, and Interest Expense. Prepare journal entries and record the transactions for August in the appropriate \(\mathrm{T}\)-accounts, using the references given.

b. Prepare a trial balance as of August 31 .

Step by Step Answer: