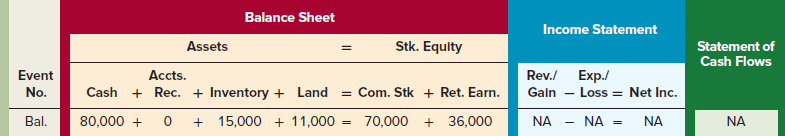

Junkers Stash started the Year 2 accounting period with the balances given in the horizontal financial statements

Question:

Junker’s Stash started the Year 2 accounting period with the balances given in the horizontal financial statements model shown below. During Year 2, Junker’s Stash experienced the following business events:

1. Paid cash to purchase $70,000 of merchandise inventory.

2. The goods that were purchased in Event 1 were delivered FOB destination. Freight costs of $1,400 were paid in cash by the responsible party.

3a. Sold merchandise for $72,000 under terms 1/10, n/30.

3b. Recognized $41,900 of cost of goods sold.

4a. Junker’s Stash customers returned merchandise that was sold for $2,100.

4b. The merchandise returned in Event 4a had cost Junker’s Stash $1,250.

5. The merchandise in Event 3a was sold to customers FOB destination. Freight costs of $1,650 were paid in cash by the responsible party.

6a. The customers paid for the merchandise sold in Event 3a within the discount period. Recognized the sales discount.

6b. Collected the balance in the accounts receivable account.

7. Paid cash of $6,850 for selling and administrative expenses.

8. Sold the land for $9,100 cash.

Required

a. Show the above transactions in a horizontal financial statements model like the one shown next:

b. Determine the amount of net sales.

c. Prepare a multistep income statement. Include common size percentages on the income statement.

d. The return-on-sales ratio for Junker’s Stash during the prior year was 12 percent. Based on the common size data in the income statement, did the expenses for Junker’s Stash increase or decrease in Year 2?

e. Explain why the term loss is used to describe the results due to the sale of land.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds