Laura Moss started and operated a small family consulting firm in Year 1. The firm was affected

Question:

Laura Moss started and operated a small family consulting firm in Year 1. The firm was affected by two events:

(1) Moss provided $36,000 of services on account,

(2) she purchased $10,000 of supplies on account.

There were $1,800 of supplies on hand as of December 31, Year 1.

Required

a. Open T-accounts and record the two transactions in the accounts.

b. Record the required year-end adjusting entry to reflect the use of supplies.

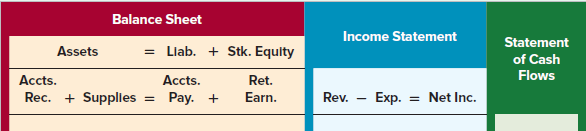

c. Show the above transactions in a horizontal statements model like the following one:

d. Explain why the amounts of net income and net cash flow from operating activities differ.

e. Record and post the required closing entries, and prepare a post-closing trial balance.

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds