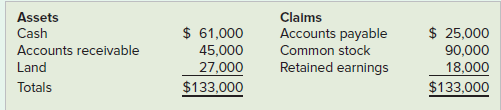

Oaks Company had the following balances in its accounting records as of December 31, Year 1: The

Question:

Oaks Company had the following balances in its accounting records as of December 31, Year 1:

The following accounting events apply to Oaks’s Year 2 fiscal year:

Jan. 1 Acquired an additional $70,000 cash from the issue of common stock.

1 Purchased a delivery van that cost $26,000 and that had a $7,000 salvage value and a five year useful life.

Mar. 1 Borrowed $21,000 by issuing a note that had an 8 percent annual interest rate and a one year term.

April 1 Paid $6,600 cash in advance for a one-year lease for office space.

June 1 Paid a $3,000 cash dividend to the stockholders.

July 1 Purchased land that cost $25,000 cash.

Aug. 1 Made a cash payment on accounts payable of $13,000.

Sept. 1 Received $8,400 cash in advance as a retainer for services to be performed monthly during the next eight months.

Oct. 1 Purchased $900 of supplies on account.

Dec. 31 Earned $80,000 of service revenue on account during the year.

31 Received $56,000 cash collections from accounts receivable.

31 Incurred $16,000 in other operating expenses on account during the year.

31 Incurred accrued salaries expense of $5,000.

31 Had $250 of supplies on hand at the end of the period.

Required

Based on the preceding information, answer the following questions. All questions pertain to the Year 2 financial statements.

a. What additional four adjusting entries are required at the end of the year?

b. What amount of interest expense would Oaks report on the income statement?

c. What amount of net cash flow from operating activities would Oaks report on the statement of cash flows?

d. What amount of rent expense would Oaks report on the income statement?

e. What amount of total liabilities would Oaks report on the balance sheet?

f. What amount of supplies expense would Oaks report on the income statement?

g. What amount of unearned revenue would Oaks report on the balance sheet?

h. What amount of net cash flow from investing activities would Oaks report on the statement of cash flows?

i. What amount of interest payable would Oaks report on the balance sheet?

j. What amount of total expenses would Oaks report on the income statement?

k. What amount of retained earnings would Oaks report on the balance sheet?

l. What total amount of service revenues would Oaks report on the income statement?

m. What amount of cash flows from financing activities would Oaks report on the statement of cash flows?

n. What amount of net income would Oaks report on the income statement?

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds