The 2017 financial statements of LVMH Moet Hennessey Louis Vuitton S.A. are presented in Appendix C at

Question:

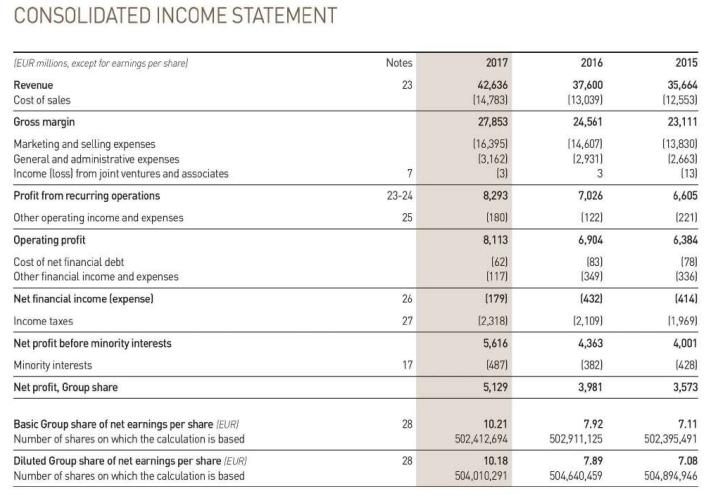

The 2017 financial statements of LVMH Moet Hennessey Louis Vuitton S.A. are presented in Appendix C at the end of this book. LVMH is a Paris-based holding company and one of the world's largest and best-known luxury goods companies. As a member of the European Union, French companies are required to prepare their consolidated (group) financial statements using International Financial Reporting Standards (IFRS). After reviewing LVMH's consolidated financial statements, consider the following questions.

Required

a. Identify two assets listed in the group balance sheets that indicate that LVMH uses the accrual basis of accounting. Which income statement accounts of LVMH are affected by adjustments to these assets accounts?

b. Identify two liabilities listed in the group balance sheets that indicate that LVMH uses the accrual basis of accounting. Which income statement accounts of LVMH are affected by these adjustments?

Appendix C

Step by Step Answer: