The following data were obtained prior to the acquisition of Gillette Company by Procter & Gamble. Gillette

Question:

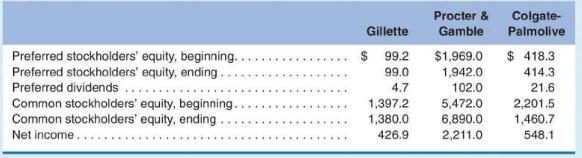

The following data were obtained prior to the acquisition of Gillette Company by Procter \& Gamble. Gillette Company, the Procter \& Gamble Company, and Colgate-Palmolive Company are three firms in the personal care consumer products industry. During the prior year, the average return on common stockholders' equity for the personal care consumer products industry was 28.1 percent. In the same year, the relevant financial data for Gillette, Procter \& Gamble, and Colgate-Palmolive were as follows (in millions):

Required

a. Calculate Gillette Company's return on common stockholders' equity.

b. Evaluate Gillette Company's return on common stockholders' equity by comparing it with the following:

1. The average for the personal care consumer products industry.

2. The return earned by the Procter \& Gamble Company.

3. The return earned by Colgate-Palmolive Company.

4. Gillette Company in the previous year (in the previous year, Gillette's net income was \(\$ 513.4\) million, preferred stock dividends were \(\$ 4.8\) million, and average common stockholders' equity was \(\$ 1,227.3\) million).

Step by Step Answer: