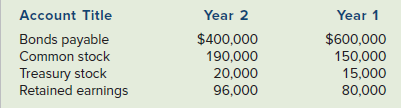

The following information was drawn from the year-end balance sheets of Longs Wholesale, Inc.: The following is

Question:

The following information was drawn from the year-end balance sheets of Long’s Wholesale, Inc.:

The following is additional information regarding transactions that occurred during Year 2:

1. Long’s Wholesale, Inc. issued $90,000 of bonds during Year 2. The bonds were issued at face value. All bonds retired were retired at face value.

2. Common stock did not have a par value.

3. Long’s Wholesale, Inc. uses the cost method to account for treasury stock. Long’s Wholesale, Inc. did not resell any treasury stock in Year 2.

4. The amount of net income shown on the Year 2 income statement was $49,000.

Required

a. Determine the amount of cash flow for the retirement of bonds that should appear on the Year 2 statement of cash flows.

b. Determine the amount of cash flow from the issue of common stock that should appear on the Year 2 statement of cash flows.

c. Determine the amount of cash flow for the purchase of treasury stock that should appear on the Year 2 statement of cash flows.

d. Determine the amount of cash flow for the payment of dividends that should appear on the Year 2 statement of cash flows.

e. Prepare the financing activities section of the Year 2 statement of cash flows.

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds