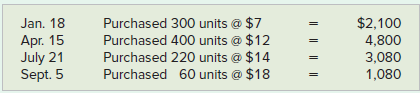

The Shirt Shop had the following transactions for T-shirts for 2018, its first year of operations: During

Question:

The Shirt Shop had the following transactions for T-shirts for 2018, its first year of operations:

During the year, The Shirt Shop sold 800 T-shirts for $25 each.

Required

a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming

the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average, rounded to two decimal places.

b. Compute the difference in gross margin between the FIFO and LIFO cost-flow assumptions.

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds

Question Posted: