Question: This exercise continues the scenario described in Exercise 1-11A shown earlier. Specifically, the Better Corp. Year 1 ending balances become the Year 2 beginning balances.

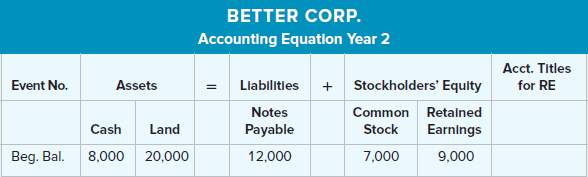

This exercise continues the scenario described in Exercise 1-11A shown earlier. Specifically, the Better Corp. Year 1 ending balances become the Year 2 beginning balances. These balances are shown in the accounting equation that appears next.

Better Corp. completed the following transactions during Year 2:

1. Purchased land for $5,000 cash.

2. Acquired $25,000 cash from the issue of common stock.

3. Received $75,000 cash for providing services to customers.

4. Paid cash operating expenses of $42,000.

5. Borrowed $10,000 cash from the bank.

6. Paid a $5,000 cash dividend to the stockholders.

7. Determined that the market value of the land on December 31, Year 2, is $35,000.

Required

a. Record the transactions in the appropriate general ledger accounts under an accounting equation. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide the appropriate titles for these accounts in the last column of the table.

b. Prepare balance sheets for Year 1 and Year 2. These statements should be presented in the vertical format with Year 1 and Year 2 shown in side-by-side columns. Recall that the Year 1 ending balances become the Year 2 beginning balances. These ending/beginning balances can be found on the first row of the table shown earlier. More specifically, the Year 1 ending balances include $8,000 cash, $20,000 land, $12,000 notes payable, $7,000 common stock, and $9,000 retained earnings.

c. How much cash is in the notes payable account?

d. How much cash is in the common stock account?

e. How much cash is in the retained earnings account? What is the balance of the cash account? Explain why the balances in the cash and retained earnings accounts are the same or different.

f. What is the amount of the land shown on the December 31, Year 2, balance sheet? Why is it shown at this amount?

BETTER CORP. Accounting Equatlon Year 2 Acct. Titles for RE Llablitles + Stockholders' Equity Common Retalned Assets Event No. Notes Payable Stock Earnings Cash Land 20,000 Beg. Bal. 7,000 8,000 12,000 9,000

Step by Step Solution

3.43 Rating (175 Votes )

There are 3 Steps involved in it

a Better Corporation Accounting Equation for Year 2 Assets Liabilities Stockholders Equity Event Cash Land Notes Payable Com Stock Retained Earnings A... View full answer

Get step-by-step solutions from verified subject matter experts