Warren, Attorney at Law, experienced the following transactions in Year 1, the first year of operations: 1.

Question:

Warren, Attorney at Law, experienced the following transactions in Year 1, the first year of operations:

1. Purchased $1,500 of office supplies on account.

2. Accepted $36,000 on February 1, Year 1, as a retainer for services to be performed evenly over the next 12 months.

3. Performed legal services for cash of $84,000.

4. Paid cash for salaries expense of $32,000.

5. Paid a cash dividend to the stockholders of $8,000.

6. Paid $1,200 of the amount due on accounts payable.

7. Determined that at the end of the accounting period, $150 of office supplies remained on hand.

8. On December 31, Year 1, recognized the revenue that had been earned for services performed in accordance with Transaction 2.

Required

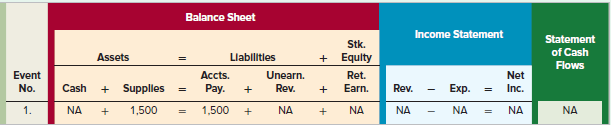

Show the effects of the events on the financial statements using a horizontal statements model like the following one. In the Statement of Cash Flows column, use the initials OA to designate operating activity, IA for investing activity, FA for financing activity, and NC for net change in cash. Use NA to indicate accounts not affected by the event. The first event has been recorded as an example.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds